Active Joint-Venture Projects Continue to Build Value for Globex Shareholders

Many joint venture partners of Globex Mining Enterprises Inc. (CA: GMX – $0.81 & US: GLBXF – $0.61 & GER: G1MN – €0.59) have continued to advance their exploration projects throughout the summer. One of these partners, Excellon Resources Inc. [EXN] updated plans to spin off the Silver City Project into a separately listed company.

The 340 km2 Silver City Project is located in Saxony, Germany within a large, high-grade epithermal system and has a long history of mining dating back to the 12th century, with no modern-day exploration for precious metals.

Globex vended the project to Excellon in a deal announced in 2019. Under the terms of the Agreement, Excellon had to pay Globex C$500,000 in cash and issue common shares of the company to Globex worth C$1,600,000 over a three year period.

Excellon also agreed to make a one-time C$300,000 payment upon the release of a maiden resource on the Silver City License and a one-time payment of C$700,000 upon the achievement of commercial production.

Moreover, EXN must also grant Globex a gross metals royalty on the Silver City License equal to 3% of precious metals and 2.5% of other metals, which can be reduced to 2% and 1.5%, respectively, with a US$1,500,000 payment.

Ongoing activity at Silver City has focused on several of the historic mines within the property area, delivering some notable discoveries including high-grade silver and base metals.

The value proposition for the Silver City project may be enhanced through transferring the asset into a separately listed, European-focused exploration company. The timing and structure of this pending reorganization remains under consideration. However, the creation of a pure play junior silver explorer to advance Silver City is expected to unlock greater shareholder value. This of course is welcome news for Globex shareholders, as the Company controls a significant minority interest of Excellon shares.

Radisson Mining Resources Advances the O’Brien Project

Another transaction partner, Radisson Mining Resources Inc. [RDS], has been active exploring for gold in Quebec. This week, Radisson issued an update pertaining the progress at its O’Brien project. O’Brien was consolidated from several smaller land holdings within the Cadillac Break structural corridor and encompasses three past-producing gold mines. The project is notable for the high-grade gold intervals that have been encountered during several years of exploration. Five enriched gold trends have been identified so far within the property area to the east of the past-producing O’Brien gold mine.

Among the assay results issued this week, a section of 2m carried an average of 17.11 g/t gold in trend #3. Visible gold was observed in some of the drill core. Including the most recent batch of assay results, Radisson has delivered 141 drill core intercepts with at least 5 g/t gold. Of these, 59 intercepts were enriched with at least 10 g/t gold.

The ambitious exploration work commenced in 2019. Radisson completed 255 drill holes so far for a total of 127,600m of drilling. When all the data has been received, an updated resource estimate for the project will be presented, which is expected by early next year.

Globex retains royalty leverage in perpetuity. A 2% NSR is held on the Kewagama claims, while a 1% NSR is held for the New Alger property claims.

Royalty Leverage Tied to Lithium Properties

Lithium has been one of the hottest commodities in the resource sector for the past years, primarily due to the high demand for the metal to use in batteries that power electric vehicles. Globex was an early player to recognize this trend, securing control for numerous property holdings in Quebec that were prospective for lithium exploration. The corporate strategy involved arranging transactions for many of these lithium projects, while retaining a royalty interest.

In one such deal, Globex established a significant partnership with Electric Royalties Ltd. [ELEC], vending a package of royalty interests that included leverage to lithium and other specialty metals for a cash and shares. Following this deal, the partners expanded their relationship with another transaction that enabled Globex to build a position of approximately 12 million shares of ELEC, plus a further 5.5 million common share purchase warrants.

In an update, Electric Royalties gave more information on several of the properties that feature royalty leverage. Most interesting is the Authier Lithium Project, which is operated by Sayona Mining Ltd., and in which Electric Royalties holds a GMR of 0.5%. Sayona recently announced that it is on track to restart lithium production early next year at its Lithium operation in Quebec, becoming the only local lithium supplier in North America, after having committed around $100 million to the restart. Globex also retains a 0.5% GMR on the Authier deposit.

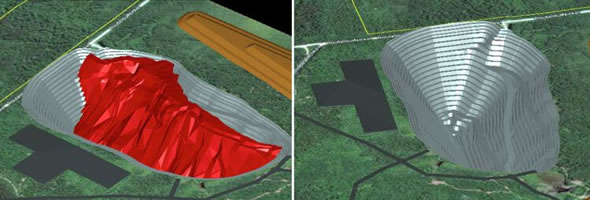

The current pit optimisation at Authier has the mineralisation extending down to 200 metres depth but the deposit remains open in all directions.

The Sayona plan involves combining resource feed extracted from the Authier project to enhance the total lithium production from its Quebec Lithium deposit. Therefore, both ELEC and Globex will begin receiving royalty payments based on the Authier lithium resources that are run through this operation.

As a significant minority shareholder of Electric Royalties, Globex obviously welcomes these successful developments.

Conclusion

The strategy to secure attractive properties and arrange JV transactions has been highly effective for Globex to create shareholder value. Part of this success is due to the high quality of the companies that Globex is partnered with. Exploration and development work funded by partner companies has achieved notable success at several JV projects.

Meanwhile, Globex often receives payments in share capital for these transactions. This minority ownership position enables Globex to capture gains in market value as the projects are advanced. Transactions with Electric Royalties secured 12 million shares plus warrants and cash payments. The market value of the share ownership alone is nearly $3 million. Globex also received 9,550,000 shares of Renforth Resources [RFR] in the original transaction to vend the Parbec gold property. In a subsequent transaction with Renforth, Globex increased it’s royalty interest on the Parbec deposit to a 3% Gross Metal Royalty and got a 1% NSR on the New Alger property which is now consolidated into the O’Brien project. The final installment of payments due for the Silver City property will also include the issuance of a significant position of Excellon shares. Globex may hold these shares as an ongoing investment in the success of the properties or sell them in the market to realize additional revenue.

Globex also holds royalty leverage on many of the properties vended to other companies. For example, a 0.5% GMR is held on the Authier property in addition to 2% GMR leverage held for some of the lithium claims in the immediate vicinity. Globex retains royalty leverage for much of the Radisson consolidated O’Brien land package. The Silver City project may be rolled into a new public company, but Globex shall continue to retain royalty leverage on any successful development of that exciting project. The combined efforts of numerous partner companies advancing a diversified portfolio of property assets ensure that Globex shareholders continue to participate in a wide variety of successes achieved in the field. Smallcaps Recommendation: BUY.

| Smallcaps.us Advice: Buy | Price Target: $2.87 | Latest Company Report (pdf) |

| For important disclosures, please read our disclaimer. | ||