Divestiture of Non-Core Royalties Creates Significant Value for Globex Shareholders

Globex Mining Enterprises Inc. (CA: GMX – $0.47 & US: GLBXF – $0.33 & GER: G1MN – €0.31) has already demonstrated the capacity to create shareholder value through the drill bit. This multidimensional Company has also proven the proficiency to complete profitable transactions. On numerous occasions over the last couple of years, Globex has recognized a valuable property for acquisition that was overlooked by other players. Many of these acquisitions have led to subsequent transactions leading to substantial capital gains.

While the management of a large and diversified portfolio of property assets is bearing fruit, another component to the business strategy is also in play. Globex owns royalty interests for about 60 properties. These royalties generate a payment stream to the Company for any production of the specified metals that may occur in perpetuity. For example, the Mid-Tennessee Mines project operated by Nyrstar issues significant recurring income to Globex. Many other royalties are held for advanced properties approaching development.

This week, Globex reported a transaction involving its royalty portfolio. The Company reached a deal to vend interests for five royalties (or portions of royalties) that are considered non-core holdings. This transaction was arranged with Electric Royalties Ltd [ELEC]. ELEC is a new company established to provide royalty leverage to specialty metals and minerals used for green energy applications.

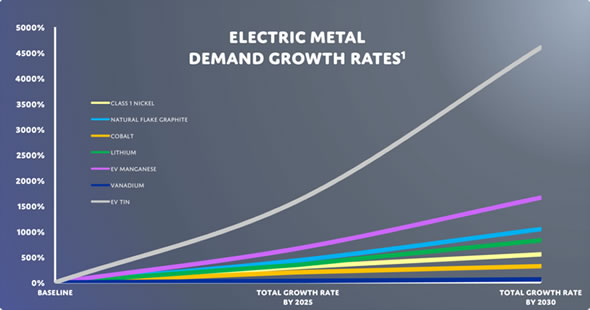

Market analysts have suggested that worldwide production of these critical elements is insufficient to meet expected demand. Incentives are being rolled out to encourage the adoption of environmentally friendly technologies. New sources of production and supply will be required to support subsequent demand growth. This is expected to provide a tailwind for exploration and development activity for the properties involved in this transaction.

Transaction Terms

Globex has chosen to focus on other opportunities within its asset portfolio. The decision to vend these interests to a third party therefore provides direct benefit without reducing the longer term upside. Globex will receive immediate payment of $500,000 in cash. In addition, Globex will receive 3 million shares of ELEC, which are worth $855,000 at today’s share price. This represents more than 6% ownership of Electric Royalties and creates leverage to potential future growth for these royalty holdings.

In total, royalty leverage to five separate property interests are involved in this deal. A 1% Gross Metal Royalty (GMR) was transferred for all vanadium produced from the Mont Sorcier project in Quebec. This property was rolled into Chibougamau Independent Mines Inc. in 2011. Globex continues to retain a GMR of 1% for iron, titanium and any other metal produced from this property.

A 2% GMR for manganese production from the Battery Hill property in New Brunswick was also transferred. Globex continues to retain a 1% GMR for the property. The Company acquired this project in 2010. Drilling work completed the following year demonstrated attractive intervals bearing manganese. The project was then vended to Manganese X Energy Corp in 2017. Globex received Manganese X shares in the transaction as the property is advanced by its partner.

Leverage to Lithium Royalties Featured

Lithium is considered one of the most important energy metals as it is incorporated into the batteries used to power electric vehicles. Although abundant lithium deposits have been identified, the scale of production will have to increase substantially to meet expected demand for this new consumption.

Also as part of this agreement, several lithium royalty interests were transferred to ELEC. A GMR of 0.5% was transferred for the central claim of the Authier Lithium property in Quebec. This advanced project is controlled by Sayona Lithium Mining Ltd. Sayona has delivered a Definitive Prefeasibility Study with the potential to develop a lithium mine. Globex retains a 0.5% GMR on this project.

Globex also controls Authier property claims adjacent to the Sayona claims. A 0.5% GMR was transferred for one of these claims, for which Globex continues to retain a 1.5% GMR. Globex transferred the entire 2% GMR for other Authier claims. In the event that the Authier deposit is advanced to production within 6 years, Globex shall also receive a further $250,000 cash payment adjusted for inflation.

Finally, Globex transferred a 2% GMR for the Chubb and Bouvier projects. Located north of La Motte, Quebec, these properties are held by Great Thunder Gold Corp. Globex received a cash payment and shares of Great Thunder in the original transaction to vend the property interest. This additional royalty transaction may be considered a bonus divestiture.

Conclusion

There is a recurring theme for each of the projects involved in this transaction. Globex initially acquires property holdings with leverage to specific metals and minerals. Thereafter the Company advances these projects to attract partners and arrange subsequent transactions. These deals involve cash and share capital, thereby contributing gains for Globex shareholders. Retained royalty interests provide the potential to add further value from these projects. Like the gift that keeps on giving, Globex is once again realizing a financial benefit for projects that are no longer considered primary assets.

Note also the full cycle value creation prospect earned through this proactive approach. For example, very few companies were interested in lithium deposits in 2010. Fast forward to today and these deposits are now much more valuable. The foresight to secure attractive projects before they become sought after enables a greater value proposition for shareholders.

The minority ownership of partner companies is also a strategy for value creation. As a newly established royalty story, Electric Royalties may eventually deliver successful results and create more shareholder value. Globex may continue to hold 3 million shares acquired from this deal and participate in that outcome or the Company may opt to sell the shares to capture financial gains later on. Smallcaps Recommendation: BUY.

| Smallcaps.us Advice: Buy | Price Target: $2.87 | Latest Company Report (pdf) |

| For important disclosures, please read our disclaimer. | ||