New Cerro Jumil Drill Results Indicate Expansion of Mineralized Zones

New analytic results from several step-out drill holes on Esperanza Resources’ (EPZ – $1.35) Cerro Jumil project in Mexico, indicate an extension of the currently known gold mineralized Calabazas and Southeast Zones.

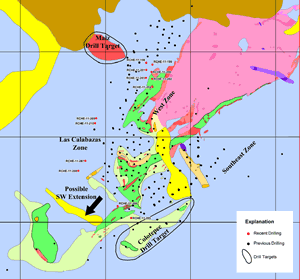

Holes RCHE-205, 206 and 208 (see map below), which were drilled to find out if mineralization continued in southwestern direction, all intersected gold mineralized veins (see table at bottom). This will have a positive impact on the property’s resource estimate.

Current Drill Program

In April 2011, Esperanza commenced a 15,000 metres drill campaign aimed at both expanding the known gold resource and advancing parts of the resource from an inferred to an indicated category. So far, results from 36 holes, totaling 5,566 metres, show additional mineralized veins between 0.67 and 3.85 grams of gold per tonne on the property.

The Company now continues infill drilling of the West Zone and exploration of the Maiz target area. Additionally, the newly identified southwestern extension, as well as the Colotepec target, will be explored (also see map below).

Resource Estimate & PEA

A September 2010 NI 43-101 compliant resource estimate for Cerro Jumil includes 935,000 gold equivalent ounces in the measured and indicated categories and 233,000 gold-equivalent ounces in the inferred category. Results from 251 drill holes, totaling 41,750 metres were used to derive these numbers.

In September 2011, Esperanza published results of an independently prepared Preliminary Economic Assessment (PEA) for Cerro Jumil based on the 2010 resource estimate. The PEA shows that, at a very conservative gold price of $1,150 per ounce, the project has an after tax Net Present Value (NPV) of $122 million at a 5% discount rate generating an Internal Rate of Return (IRR) of 26%. At a near present gold price of $1,700 per ounce, Cerro Jumil produces an after tax NPV of $309 million and an IRR of 53%.

Conclusion

I’m pleased with the drill results from Cerro Jumil as they expand the mineralized areas. Knowing that much more drilling in high prospective zones is still ahead, I’m confident that a following resource estimate will move the property to +1 million gold equivalent ounces in the measured and indicated categories.

| Hole Number | From (meters) | To (meters) | Interval (meters) | Gold Grade (g/t) |

| RCHE-11-200 | 0.0 | 6.0 | 6.00 | 1.03 |

| RCHE-11-205 | 156.0 | 183.0 | 27.00 | 1.04 |

| 205.5 | 213.0 | 7.50 | 0.95 | |

| RCHE-11-206 | 115.5 | 126.0 | 10.5 | 0.74 |

| 198.0 | 214.5 | 16.50 | 0.67 | |

| 270.0 | 295.5 | 24.0 | 1.24 | |

| RCHE-11-208 | 118.5 | 130.5 | 12.00 | 1.57 |

| 189.0 | 210.0 | 21.0 | 0.98 | Second series of analytic results from the ongoing 15,000 metres drill campaign at Cerro Jumil, again showing interesting mineralized veins. Note, all holes not mentioned in the table between RCHE-11-198 and RCHE-11-210, had no significant mineralization. |

|

| Smallcaps.us Advice: Buy | Price Target: $2.40 | Latest Company Report (pdf) |

| For important disclosures, please read our disclaimer. |