Latest Transactions Involving Lithium Properties Build Diversification of Royalty Interests for Globex

The importance of the portfolio of royalty interests held by Globex Mining Enterprises Inc. (CA: GMX – $1.45 & US: GLBXF – $1.16 & GER: G1MN – €1.05) has taken center stage in the last couple of years as the Company has delivered multiple high-value transactions. The highlight of these transactions was the sale of the Middle Tennessee Mines Royalty to Electric Royalties Inc (ELEC) worth well over $15 million.

This week, Globex reported two transactions with First Energy Metals Ltd. (FE) involving royalties. The first deal vended 18 claims to FE including the formerly producing Preissac Molybdenite Mine and the Moly Hill Molybdenite deposit. Globex shall receive payment of $30,000 in cash plus 375,000 shares of FE (currently worth $90,000). The Company also retains a 1% GMR on these claims. The second part of this transaction involved a ‘Prospector’ group of 417 claims prospective for lithium and other resources. Globex retains a 0.5% GMR on all of these claims.

Updated map of First Energy Metals claim Holdings after Globex agreement

Recall that Globex had already engaged in a property transaction with FE for another package of 66 claims in June 2021. Some of these claims are also prospective for lithium. Globex retains a 3% GMR on this property package. The combined transactions with FE involve a total of 501 claims where Globex controls royalty interests.

The Company also has a lithium royalty interest in the area through a previously reported transaction with Sayona for the Authier Lithium deposit in July 2020. The enhanced leverage to lithium is another catalyst for value creation within the diversified royalty portfolio held by Globex. Lithium is a critical commodity that is projected to remain in high demand due to the steady demand related to the manufacturing of electric vehicles.

Significant Cash Windfall Secured with Transaction Involving Mooseland Gold Mine Property

Earlier, Globex reported that NSGold Corporation (NSX) had announced a transaction to sell the Mooseland Gold Mine Property. NSX had originally acquired this project through a deal with Globex. Among the terms of this arrangement, Globex was issued a total of 1,745,408 shares of NSGold.

The Mooseland property transaction has now closed. Atlantic Mining NS Inc. has agreed to purchase all outstanding shares of NSGold for 40 cents per share. This amounts to a net cash settlement of $698,163.20 paid to Globex for its minority ownership position.

However, Globex continues to retain a 2% GMR on the property, which is good news as a compliant inferred resource amounting to 523,000 ounces of gold has already been presented for Mooseland. Additional exploration work may increase the total defined resources of the deposit. Underground access and supporting infrastructure is also advanced, allowing for an easier path to commence production.

This transaction to acquire the advanced Mooseland project opens the prospect for a satellite mining operation to commence production. Atlantic is actively mining at its Moose River Consolidated Gold Mine operation located just 13kms from Mooseland. Based on the royalty leverage, all gold production from Mooseland would secure a recurring income stream payable to Globex. Once again, Globex is positioned to benefit from the activity of a third-party company without the requirement to participate in the development costs of the underlying deposit. This illustrates the strength of the royalty portfolio.

Other Transactions Contribute Additional Value for Globex Shareholders

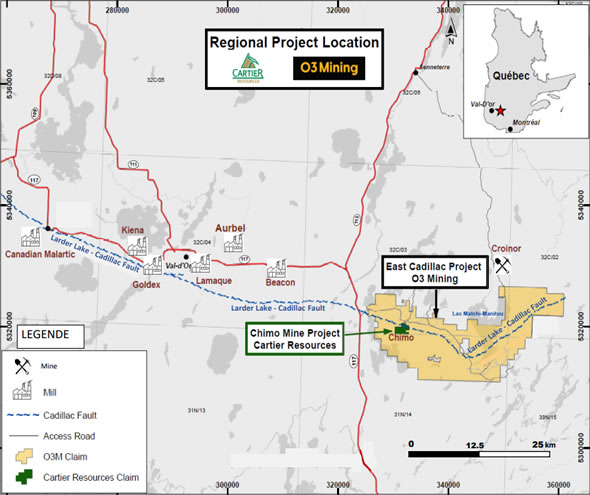

Another transaction was reported earlier this month involving a legacy asset formerly held by the Company. O3 Mining had previously acquired property interests comprising 54 claims from Globex that were assembled into the East Cadillac Gold project. A technical report for the property, filed in 2021, documented an Indicated gold resource of 684,000 ounces of gold plus nearly 1.4 million ounces Inferred. On March 7th 2022 a LOI was announced for the acquisition of the property, by Cartier Resources Inc. (ECR). Cartier will amalgamate East Cadillac with its adjacent Chimo Mine property holdings. The consolidated project area will amount to an impressive area of 29,754 hectares.

Consolidation of Cartier’s Chimo Mine property with O3 Mining’s East Cadillac property for a total land position of 29,754 hectares of highly prospective ground in the eastern part of the prolific Val-d’Or gold camp

As with the aforementioned Mooseland Gold Mine Property, Globex continues to hold royalty leverage against the 1,454 hectares of the consolidated property area from the 54 claims originally vended to O3 Mining. This 3% GMR interest may become more relevant as Cartier plans to advance the Chimo Mine property with additional exploration work in the months ahead. The potential to add further gold resources to the already substantial deposit area may contribute critical mass to the overall gold endowment of the project necessary to support development of a producing gold mine.

Conclusion

Globex engages in transactions whereby its partners are obligated to complete exploration activity that may build resource leverage on the properties. The successful advancement of these properties then may enhance the prospect for development of a producing mine that carries the benefit of a recurring royalty stream to Globex. Even as some of these properties are ultimately vended to other companies, the royalty interests are held in perpetuity. Indeed, the endowment of defined resources is often the catalyst for these subsequent deals, as was reported in the recent transactions involving the Mooseland Gold Mine and East Cadillac Gold projects. Globex is not required to fund exploration and development expenses, but may await a favorable outcome as these advanced projects may eventually commence production.

Globex has also received additional cash to bolster its already solid balance sheet. The steady flow of cash receipts related to numerous successful transactions has created the largest working capital position in the history of the Company. This is also likely a contributing factor to the recent achievement of a new 52-wk high share price recorded this month.

The balanced strategy to assemble and advance the suite of diversified property holdings, build leverage to attractive royalty interests and pursue profitable transactions with partner companies, has delivered significant gains for shareholders. As the market conditions continue to support the outlook for stronger commodity prices, this winning streak is likely to continue. Smallcaps Recommendation: BUY.

| Smallcaps.us Advice: Buy | Price Target: $2.87 | Latest Company Report (pdf) |

| For important disclosures, please read our disclaimer. | ||