How Globex Mining Increases its Royalty Portfolio

Commodity prices have been trending higher in recent years, which is good news for mining companies. At the same time, it is very good news for the holders of royalties on mining properties. A royalty is usually based on a percentage of the gross metal production from a mine, or on net smelter (refined) production.

The advantage for a royalty holder is that one is not leveraged to the cost side of the ledger, or the ongoing continued investment to maintain a mine project. As long as the mines continue operating, there is a royalty payment generated. This arrangement has proven to be so lucrative that some companies are set up entirely as royalty plays, and the steady stream of cash flow generated from these royalties has led to premium market valuations for these companies.

Globex Mining Enterprises Inc. (TSX: GMX – $0.41 & OTCQX: GLBXF – $0.33 & Fra: G1MN – €0.25) has chosen a hybrid approach, as the Company has endeavored to establish a suite of royalty interests that is complimentary to its holdings of resource properties. In fact the strategy to advance projects and then complete transactions with other companies often generates a royalty for Globex as part of the deal, so there is often a direct synergy achieved.

Similar to mineral rights, royalties may also be bought or sold for a cash consideration, and existing royalty agreements may be resold without any involvement at all from the holder of the underlying property interests.

Purchase of New Royalty at High Profile Quebec Mining District

Globex this week announced it had purchased a Net Smelter Royalty (NSR) on the Kewagama Gold Mine property in Quebec. This property is located within the prestigious Cadillac Trend, a corridor of highly prospective geology that has been one of the most productive gold belts in all of Canada for more than 100 years.

The terms of the royalty are structured such that a cash payment representing 2% of the Net Smelter Value is due for all production that may be generated from the three claims that comprise the property. There is currently no ongoing mining underway at this project, however the NSR remains in effect should future development of a producing mine be completed, and the royalty is automatically carried over if the property itself is transferred to another company.

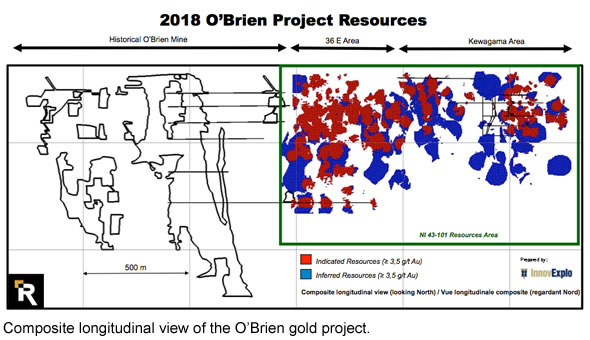

The Kewagama Gold Mine is owned by Radisson Mining Resources Inc. (RDS-TSXV) and forms the eastern portion of their O’Brien Gold Project covering an area of 111.7 ha (276 acres). Last month Radisson reported an updated resource estimate for the O’Brien project documenting 233,491 ounces of gold in the Indicated category and 194,084 ounces of gold in the Inferred category, nearly doubling the previously outlined gold resource for the property.

Radisson has indicated that aggressive exploration will continue at both O’Brien and Kewagama. In fact, a couple of days ago, Radisson announced the expansion of the ongoing drill program to 11,000 meters, up from 6,000 meters. This is good news for Globex shareholders. Considering the successful results achieved in previous rounds of exploration, it is likely that the gold resource will increase further as this talented team follows up with more work. If a suitable total gold resource is ultimately proven up to achieve critical mass to warrant the development of a mine, then the royalty held by Globex will begin to generate cash payments with the commencement of production.

While Globex is not required to commit any funding towards the further development of the Kewagama Gold Mine, the royalty becomes more valuable. Globex shareholders may happily watch for successful discovery results in the future for this project knowing that the endowment of gold for the life of any sustained mining will result in a greater cash payment.

Increased Mineral Inventory for Middle Tennessee Mines Extends Duration of Royalty Payments

This potential for a successful outcome is effectively illustrated by the productive royalty held by Globex, related to the Mid Tennessee Mines (MTM) project operated by Nyrstar NV (OTC – NYRSF). Globex is entitled to a 1.4% royalty when LME zinc prices are at or over US$1.10 per lb, and a 1% royalty when the zinc price is between US$0.90 and US$1.09 per lb. The Company reported that for the month of January 2018 the royalty generated a cash payment of US$177,179 from Nyrstar to Globex. With the mine now running near full capacity it is expected that this royalty may amount to more than CDN$2 million in 2018. See the Globex home page for an overview of Nyrstar’s y payments up to and including march 2018.

However, there is more good news to this story. In March 2018, Nyrstar reported that it generated approximately 0.76 million tonnes mill throughput at an average grade of 3.12% Zn to the end of 2017. In terms of Resources however, a total of 1.08 million tonnes of Reserve and 730 thousand tonnes of Measured and Indicated Resources ware added, and this was due to discovery of extensions to mineralization and re-modelling parts of the orebody. Consequently, with Zinc price where it is today, it’s safe to assume that Globex shareholders will continue to benefit from Nyrstar’s royalty payments.

Conclusion

The value proposition for Globex is enhanced by the strategy to build diversification amongst the holdings of the Company. This means that management is always working to establish ownership of multiple properties, in different jurisdictions, and with leverage to many resources. There are currently more than 160 properties controlled by Globex.

Further diversification is achieved through a portfolio of royalty agreements held by the Company. Again, these royalties range across resource leverage and development status for the various projects. There are currently more than 40 royalties held by Globex.

The synergies of this diverse asset base create opportunities for the Company to build shareholder value. Exploration success achieved at a resource property may lead to a premium transaction to vend ownership to another company and possibly create a new royalty controlled by Globex. Alternately, successful exploration work by a third party company may build increased resources that will add royalty value over the life of a mine, as was recently reported by Nyrstar.

Also Sayona Mining Limited (ASX:SYA) plans to commence production at its Authier Lithium property in Quebec in the fourth quarter of 2019. Globex holds a 1% Gross Metal Royalty (GMR) on one claim over the center of the lithium deposit and a 2% GMR on 12 other claims in the immediate vicinity of the deposit.

The combination of these high-quality assets, from control of early stage exploration prospects through to productive royalties on operating mines, enables Globex to fund a variety of work activity while maintaining a pipeline of projects that lower the overall risk profile for the Company. Recommendation: BUY.

| Smallcaps.us Advice: Buy | Price Target: $2.87 | Latest Company Report (pdf) |

| For important disclosures, please read our disclaimer. | ||