Globex Mining Benefits As Royalty Partners Report Significant Progress

It has been another exciting week for the junior mining sector. Just considering the province of Quebec, many active companies are engaged in exploration programs focused to expand historic deposit areas. Among this group, three companies independently advancing resource projects have presented progress updates that are of interest to shareholders of Globex Mining Enterprises Inc. (CA: GMX – $0.82 & US: GLBXF – $0.62 & GER: G1MN – €0.56).

This week Orford Mining Corporation [ORM] delivered an update including promising assay values from ongoing drilling work at the Joutel Eagle project. The pieces are now in place to enable the first round of drilling to commence at the Duquesne West Gold property controlled by Emperor Metals Inc [AUOZ]. Meanwhile, Cartier Resources Inc [ECR] has been diligently advancing the Chimo Mine project and presented the results of a Preliminary Economic Assessment (PEA) as it considers the merits of a development decision.

Globex retains royalty leverage on all three of these projects featured in the news updates.

Option Partner Orford Continues to Report Encouraging Assay Results

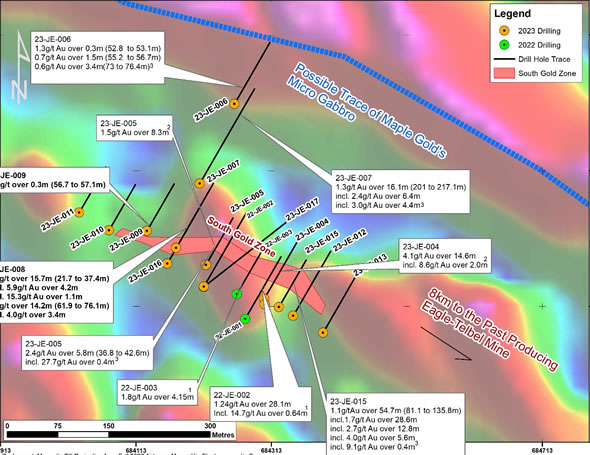

Just three weeks ago, Orford issued an update on exploration progress at the Joutel Eagle property, featuring assay results from recently completed drilling. Wide intervals of mineralization bearing attractive gold grades along strike at the South Gold Zone (SGZ) were reported. However, a newer and previously undiscovered horizon of gold mineralization was also discovered to the north of the system. This week, Orford released another batch of assay results that shed further light on this emerging discovery target.

Map of the Joutel Eagle South Gold Zone Showing New Results and Completed Drilling.

Once again, two thick intervals of attractive gold mineralization have been encountered. Drill hole JE-008 was collared in the heart of the SGZ and continued to the north. A section spanning more than 15m was encountered near surface bearing an average of 1.7gpt gold. As the hole was extended to the north, another interval of more than 14m was mineralized with an average of 2.2gpt gold. This is one of the highest grade intervals so far and indicates the potential of the northern portion of the system that remains open further to depth. Orford now refers to this emerging northern target as the North Gold Zone.

Drilling focused on the main SGZ, also yielded positive results. Drill hole JE-009 encountered a section spanning 0.30m bearing 1.2gpt gold. This narrow interval may indicate that the SGZ is pivoting to a more southerly axis as drilling continues along strike to the west. A total of 14 drill holes have now been completed, and the SGZ has been confirmed across 250m of strike length. More importantly, the results obtained in this program have exceeded the gold grades across wider intervals than revealed in historical exploration work. Additional assay results are anticipated next month.

Emperor Prepares to Launch Maiden Drilling Program at Duquesne West Gold Property

The process to commence exploration at the West Duquesne Gold property has now moved another step closer as Emperor Metals reported that it has been granted the required permits for a drilling program. With this final hurdle now resolved, Emperor has selected a contractor to complete the exploration work that is planned for the property. The program is eagerly anticipated given that a large gold resource has already been established for the project based on results achieved by previous operators. In addition, Emperor employed artificial intelligence software to compile a detailed 3D block model for the property. This enabled greater resolution to delineate historical resources and outline potential targets for new discovery.

Recall that Emperor originally acquired this project late last year through an option deal with Duparquet Assets Ltd. Globex holds 50% ownership of Duparquet and therefore shall receive half of the significant property payments of cash and Emperor shares during the terms of the agreement. Emperor is required to fund ongoing exploration activity to maintain its option commitment.

The program set to commence shortly is the first stage of the process to confirm and expand the gold resources of the project. In the event that Emperor delivers a compliant gold resource surpassing one million ounces of gold for the West Duquesne Gold property, Globex shall also receive a bonus payment of 1.25 million Emperor shares. In addition, Globex owns half of the 3% GMR royalty retains by Duparquet on the project.

Presentation of PEA for Nordeau West Property Improves Royalty Outlook for Globex

Last week Cartier presented a positive PEA study for its advanced Chimo Mine project. Highlighted within the report, the proposed mine development would include a processing plant with the capacity for 3,000 tonnes per day, enabling gold production of 116,900 ounces per year. The mine would be anticipated to operate for more than nine years. The total resources were calculated based on a technical report filed by Cartier in 2022 that documented 720,000 ounces of gold Indicated, plus another 1,633,000 ounces of gold resources Inferred.

NI 43-101 Mineral Resources Estimate for Chimo Mine and West Nordeau Gold Deposits

Within the overall resources of the project considered for the proposed development, approximately 14% of the total gold content in the mining plan would be sourced from the West Nordeau deposit area. Globex holds a 3% GMR on this portion of the property. To get this into perspective, the current resource at Nordeau West represents about an $18,000,000 potential benefit to Globex.

West Nordeau in turn represents just a small part of the land package controlled by Cartier for which Globex also retains a 3% GMR. There is also potential for the total gold resources to be expanded as further exploration is completed on these holdings.

With a robust PEA for the project in hand, the Chimo Mine project has now advanced past yet another critical stage on the path towards mine, development. Successful completion of a producing mine at the Chimo Mine project would in turn generate a windfall of royalty income payable to Globex for every ounce of gold produced from the West Nordeau deposit area. Of note, while Globex would be a beneficiary of this outcome, the Company is not obligated to contribute funding to advance the project.

Conclusion

It seems that every month there is another flurry of appealing news items that are of direct interest to Globex shareholders. Each milestone achieved along the way by partner companies builds the value proposition for Globex. Most of these active projects also involve royalty leverage with the potential for income payable to Globex in the event of a successful mine development.

Less than one year has passed since the option deal was announced with Orford for the Joutel Eagle property. Yet Orford has already delivered several drill holes with higher grade gold values across wider intervals than the previously reported historical results from the South Gold Zone. The newly discovered North Gold Zone may yet add another dimension of gold resources to this story. Orford remains committed to several more years of ambitious exploration to complete the earn-in for this project.

As the first round of drilling is set to commence shortly at the Duquesne West Gold property, Globex shareholders await a similar successful outcome to confirm the historic gold resource and perhaps Emperor will deliver new discovery zones. Meanwhile, the Chimo Mine project controlled by Cartier represents a successful example of the process to define expanded gold resources around a historic mining project. With the royalty leverage retained for Nordeau West deposit, Globex is positioned for a revenue stream from the project in the years ahead if development moves forward.

The steady progress achieved by various active partners is advancing multiple projects and is delivering greater success at no cost to Globex than Globex could have achieved independently. And, the series of weupfront payments secured by these property transactions has already substantially improved the balance sheet for Globex. The prospect of multiple royalty revenue streams to come is another catalyst to power a higher share price in the future. Smallcaps Recommendation: BUY.

| Smallcaps.us Advice: Buy | Price Target: $2.87 | Latest Company Report (pdf) |

| For important disclosures, please read our disclaimer. | ||