Globex Option Partners Report Exciting Exploration Progress

Operating under a project-generator business model, Globex Mining Enterprises Inc. (CA: GMX – $0.83 & US: GLBXF – $0.60 & GER: G1MN – €0.54) has been able to achieve numerous notable transactions in recent years. Securing high quality property assets for minimal costs during intervals of bearish market conditions enabled the Company to build up an impressive portfolio of available holdings. A gradual transition to a more bullish regime for the resource sector created the opportunity to deliver profitable option deals and joint-venture partnerships with aspiring junior explorers.

As such, Globex shareholders have benefited through the windfall of payments and capital gains realized on the most significant transactions. The Company has built up an impressive war chest of cash and working capital, and market cap has been rising slowly in tandem. It may be overlooked however that these transactions also involve substantial work commitments that are entirely funded by the partner companies. It is this ongoing exploration activity underway by several high-quality juniors advancing the projects independently that builds the long term value proposition for Globex.

This week featured updates from two Globex partners engaged in ambitious exploration efforts at historic gold mining properties located in the Joutel mining camp of Quebec. Maple Gold Mines Ltd. [MGM] and Orford Mining Corporation [ORM] have each recently issued press releases to report progress at projects involving property assets being acquired from Globex through option deals.

Their ongoing exploration efforts have successfully discovered new resource zones. The discovery of larger deposits improves the outlook for mining activity to resume at these projects. Terms of the option agreements require work to continue for several years. Therefore, this progress provides a catalyst for further speculative upside to Globex through the activity of its partners in the field.

Interpretation of Geological Data Suggests Additional Exploration Potential for Eagle Mine Property

Maple Gold commenced aggressive exploration at its Eagle Mine property shortly following signing of the option deal with Globex in 2021. Multiple rounds of exploration have been completed, amounting to more than 14,700m of total drilling so far. Impressive intervals of high-grade gold have been encountered within several distinct styles of mineralization. The main gold-bearing structure, dubbed the Harricana deformation zone, is oriented along a northwest-southeast axis.

This week, Maple presented the final batch of assay results that had been awaited from recent drilling work. This data represented about 3000m of drill core, or roughly 20% of the total drilling completed so far. Within this report, highlights included 6.3g/t gold across an interval of 2 meters, and 4.2g/t gold within 3.9m of drill core further down the same drill hole. Lower grade sections were encountered across wider intervals in several drill holes including one section of 1.1g/t gold along 14.2m of core. In another drill hole, an average of 1.0g/t gold was measured within 15.5m of continuous drill core.

The productive horizons identified in drill core often extend more than 100m beyond the primary Harricana deformation zone where the historical resources were previously mined. Maple opted to compile all current and historical drill data into a 3D model. The results of airborne geophysical surveys have also been supplemented with downhole geophysical surveying which is capable of measuring precise data within a radius of 300m around each drill hole. The 3D model suggests there is the potential for cross trending structures forming zones of gold enrichment at the intersection points. Multiple splays and gold horizons are expected to be encountered to the north of the Eagle mine. A follow up round of drilling is now in planning for the summer of 2023 to test these new target zones.

Orford Mining Reports New Discovery Zone Achieved in Drilling at Joutel Eagle Project

The Joutel Eagle project located along strike to the northwest of the Eagle mine being drilled by Maple was originally acquired by Orford in November 2021, on the premise that additional gold resources would be discovered proximal to the known South Gold Zone. This portion of the property featured an enriched gold deposit outlined along a strike length of 700 meters through drilling completed by a previous operator. The potential was validated through 1500m of drilling work last year that confirmed historic intervals and also tested extensions to the previously identified mineralized area.

Similar to the ongoing exploration underway by Maple, Orford launched a second phase of drilling earlier this year, with the main objective of to continue exploration at the South Gold Zone. In addition, the drill was shifted to investigate another target area to the north identified through geophysical surveying work.

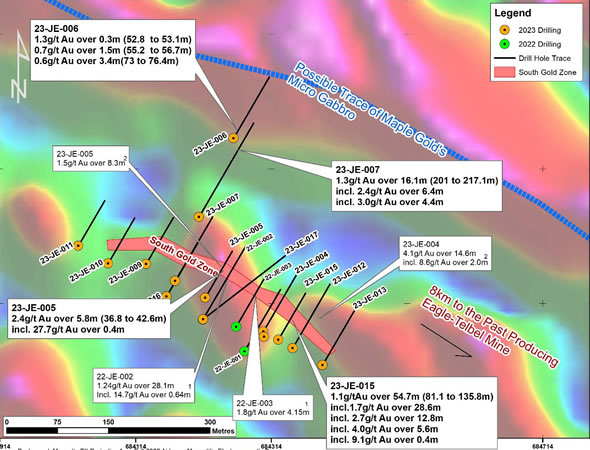

Map of the Joutel Eagle South Gold Zone Showing New Results and Completed Drilling. Note that All drilling intervals are down-hole lengths.

The first batch of assays from this phase showed broad intervals of gold mineralization with promising grades expanding the South Gold Zone. Combined with previous results, Orford has demonstrated that the South Gold Zone represents an important gold discovery target that remains open for further expansion. More importantly, a new gold-bearing horizon has been encountered roughly 150 meters to the north. The highlight interval for this new target included a section of 16.1m bearing an average of 1.3g/t gold. Orford geologists believe this previously untested area may be a parallel structure to the South Gold Zone similar to what is found at the Eagle Gold Mine 8 kilometres to the southeast.

So far, Orford has received assay results for four holes of this round of drilling. Additional assays results are pending. The early phases of drilling at the property have been able to not only confirm the historic discovery potential, but also delivered sections of higher grade, across wider intervals such as 1.1 g/t gold over 54.7 m in the last drill campaign.

Conclusion

Although the two partner companies discussed in this update are not related, there are many similarities in the exploration programs currently underway. Both the Eagle Mine property controlled by Maple and the Joutel Eagle property controlled by Orford were assembled with the addition of land positions acquired individually from Globex through option deals. Each of these projects are highlighted by historical gold resource zones and located in close proximity to past-producing mines or in the case of the Eagle Mine, is a past producer. The projects are situated within the Casa-Berardi Structural Zone, an important regional corridor of highly prospective geology for productive gold mining in Quebec. And each of these Globex option deal partners is committed to fund aggressive exploration activity in order to fulfill the terms of their earn-in obligations. Therefore, the outlook for ongoing discovery success and expanded gold resources remains very encouraging.

Globex continues to receive structured transaction payments of cash and shares of its partner companies related to these deals even as work continues. In addition, Globex shareholders remain leveraged to a positive outcome from this work that may contribute to the development of new mines at either property. Globex retains a 2.5% Gross Metals Royalty (GMR) for the Eagle Mine property, and a 3.5% GMR on the Joutel Eagle property area. Smallcaps Recommendation: BUY.

| Smallcaps.us Advice: Buy | Price Target: $2.87 | Latest Company Report (pdf) |

| For important disclosures, please read our disclaimer. | ||