Tecogen’s Record Revenues in 2018 Set Tone For Further Growth in 2019

Tecogen Inc (US: TGEN – $3.99 & GER: 2T1 – €3.34), which designs, manufactures, sells, installs, and maintains high efficiency, ultra-clean, cogeneration products, announced revenues for the fourth quarter, ended December 31, 2018, of $9,316,408, a decline of 9.3% from $10,264,163 for the same period in 2017. Although Q4 saw a decrease, the Company still achieved record revenues of $35,883,684 for the year ended December 31, 2018 compared to $33,202,666 for the same period in 2017, an 8.1% increase. This growth was aided by having a full 12 months of American DG Energy’s operations, which was acquired in May 2017. Operations in 2018 have set the tone for further revenue growth in 2019, particularly after the impressive contracts announced so far this year.

The main driver of non-acquisition revenue growth for Tecogen was chiller sales, which increased by $2,352,039, or 49%, to $7,157,771. Overall product revenue for the full year 2018 was $12,624,867 compared to $12,991,283 for the full year 2017, a decrease of 2.8%. Cogeneration sales declined by 33% in 2018, compared to 2017. Service revenue for 2018 was $16,859,291, up 2.9% from $16,377,443 in service-related revenue for the prior year. Long term service contracts represented 24% of total revenue. These service contracts help to stabilize and secure revenue going forward and steadily improve cash flow.

Mr. Benjamin Locke CEO of Tecogen commented, “2018 was a transformational year for the Company. We adjusted our product mix and sales strategy to maximize our opportunity with our exclusive natural gas engine cooling technology; substantially improved the profitability of the ADG fleet; and made significant progress developing our Ultera emissions technology for fork truck and automotive applications. Our recent transaction strengthened our balance sheet and puts us in an excellent position to achieve our 2019 goals.”

Fourth Quarter Financial Highlights

Product revenues in the fourth quarter of 2018 were $3,702,610 compared to $4,642,124 for the same period in 2017, a decrease of 20.2%. Service revenues in the fourth quarter of 2018 were $3,964,852 compared to $4,118,406 for the same period in 2017, a decrease of 3.7%. Energy production revenues in the fourth quarter of 2018 were $1,648,946, compared to $1,503,633 for the same period in 2017, an increase of 9.7%. Energy production revenue represents energy revenues earned during the quarter by the American DG Energy sites.

Consolidated gross profit for the fourth quarter of 2018 was $3,711,367 compared to $3,795,081 in the fourth quarter of 2017, a decrease of 2.2% in overall gross profit year over year. When compared to the decline in revenue for the quarter, this result is actually quite good and is driven by an increase in overall gross margin for the fourth quarter of 2018 to 39.8% from 37% for the same period in the prior year. Services and energy production margin both increased substantially over the fourth quarter of 2017. Service margin increased from 33.5% to 38.7% and energy production margin increased from 34.8% to 41%. Product gross margin stayed about flat for the quarter: 40.5% in Q4 2018 versus 40.7% in Q4 2017.

Tecogen’s net income for the fourth quarter of 2018, exclusive of goodwill impairment, was $18,686 compared to an income of $268,981 for Q4 2017, a decrease of $250,295. Operating expenses excluding the goodwill impairment rose 7% with much of the increase being due to legal fees in connection with the acquisition of American DG Energy Inc, as well as selling expenses incurred from an increased focus on chiller sales. R&D expenses increased 3% for the quarter.

Non-GAAP EBITDA, which excludes non-recurring merger related costs, goodwill impairment, mark to market adjustments and stock compensation expense, was $502,160 for Q4 2018, down 5.8% from $532,160 in Q4 2017.

Full Year 2018 Financials and Balance Sheet

| Three Months Ended December 31 | Full Year Ended December 31 | |||

| Amounts in $000’s | 2018 | 2017 | 2018 | 2017 |

| Product Revenues | 3,703 | 4,642 | 12,625 | 12,991 |

| Service Revenues | 3,965 | 4,118 | 16,859 | 16,377 |

| Energy Production | 1,649 | 1,504 | 6,400 | 3,834 |

| Total Revenues | 9,316 | 10,264 | 35,884 | 33,203 |

| Cost of Products Sales | 2,201 | 2,751 | 7,798 | 8,012 |

| Cost of Services Sales | 2,431 | 2,738 | 10,693 | 10,202 |

| Cost of Energy Production | 973 | 981 | 3,801 | 2,035 |

| Total Cost of Sales | 5,605 | 6,469 | 22,292 | 20,248 |

| Gross Profit | 3,711 | 3,795 | 13,592 | 12,954 |

| Total Operating Expenses | 8,122 | 3,487 | 19,130 | 12,729 |

| Income (Loss) from Operations | (4,411) | 308 | (5,538) | 225 |

| Net Income (Loss) | (4,372) | 269 | (5,709) | 47 |

| Earnings (Loss) Per Share | (0.18) | 0.01 | (0.23) | (0.00) |

| Shares Out. – Diluted | 24,822 | 23,343 | 24,816 | 23,343 |

| Selected income statement data for the quarters and full year ended December 31, 2018 and December 31, 2017. Source: Company Filing | ||||

Product revenues for 2018 were $12,624,867 compared to $12,991,283 in 2017, a decrease of 2.8%. Service revenues for 2018 were $16,859,291, compared to $16,377,443 in 2017, an increase 2.9%. Energy production revenues for 2018 were $6,399,526, compared to $3,833,940 for the same period in 2017. Note though that the 2017 energy production revenue only represents revenues earned after May 19, 2017, the day after the acquisition of American DG Energy through the end of the year.

Operating expenses (excluding the goodwill charge) increased to $14,739,581 for 2018 compared to $12,729,252 in 2017, an increase of 15.8%. This is largely driven by the acquisition of American DG Energy Inc. R&D expenses increased 38.5% for the year. Tecogen recorded a net loss of $5,708,532 ($1,317,942 excluding the goodwill charge) for 2018 compared to income of $47,436 for 2017. Adjusted EBITDA declined to $217,454 in 2018 from $1,102,780 in 2017.

| Amounts in $000’s | December 31, 2018 | December 31, 2017 |

| Cash and Cash Equivalents | 273 | 1,673 |

| Accounts Receivable | 14,176 | 9,537 |

| Inventories | 6,295 | 5,131 |

| Total Current Assets | 26,369 | 21,661 |

| Property and Equipment | 11,273 | 12,266 |

| Intangible Assets | 2,894 | 2,896 |

| Goodwill | 8,975 | 13,366 |

| Total Assets | 49,904 | 50,671 |

| | | |

| Revolving Line of Credit | 2,009 | – |

| Accounts Payable | 7,153 | 5,095 |

| Accrued Expenses | 1,528 | 1,417 |

| Total Current Liabilities | 13,198 | 8,708 |

| Deferred Revenue | 2,376 | 538 |

| Unfavorable Contract Liability | 6,293 | 7,730 |

| Total Liabilities | 21,867 | 16,976 |

| Total Stockholder Equity | 27,783 | 33,240 |

| Selected balance sheet data for the quarters ended December 31, 2018 and December, 2017. Source: Company Filing | ||

Current assets at year-end of $26,368,572 were double the current liabilities of $13,198,320. Current liabilities as of December 31, 2018 included $2,009,435 of short-term debt on the Company’s revolving line of credit.

Backlog Has Skyrocketed In Early 2019 Due To Record Sales Announcements

Backlog of product and installation projects grew to $16.6 million at year end 2018 compared to $15.7 million at year end 2017 and at the end of the third quarter of 2018, but this does not tell the full story. Product and installation backlog has nearly doubled in the three months since then to $29.9 million as of March 25, 2019, with product related backlog at $15.4 million and installation backlog at $14.5 million. The chart below from Tecogen’s corporate presentation puts a visual on backlog growth which has steadily grown from 2015 and spiked since the start of 2019.

This spike in backlog is largely due to two of the most significant contracts

the Company has signed to-date occurring over the last two months.

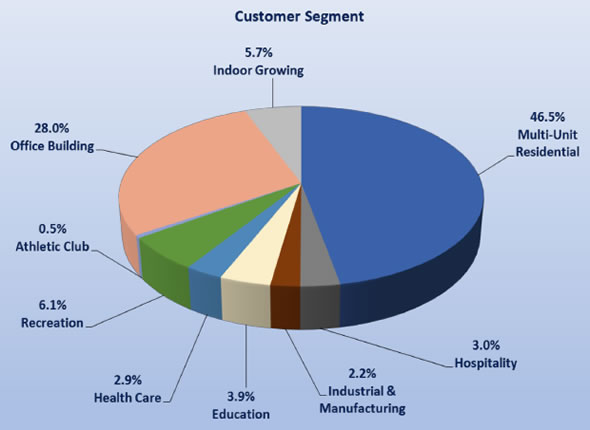

The increase in the office building segment (see chart below) is driven by the largest order in the Company’s history, the $8.3 million deal involving a charge generation system for a data center located in Manhattan office building. The contract announced three weeks ago is responsible for a large portion of the multi-unit residential segment.

This pie chart gives investors an insight into backlog by customer segment

The most compelling part of this chart however, is be the indoor growing sector, which represents only 5.7% of all backlog but Mr. Locke decided to lead with this segment when discussing backlog. He stated on the call, ”We are continuing to aggressively promote our chillers for indoor growing facilities with crops such as fruit, vegetables or cannabis in some states. Our chillers are ideally suited to these facilities because of the low operating cost of the Tecochill chillers compared to electric chillers and utilizing the waste heat from our chillers for heating and/or dehumidification of the growth states. Our systems have become the design basis for several large growers who are planning additional facilities. I expect more orders for our equipment in this space in the coming months.”

Note that the backlog does not include recurring service contract revenues, nor does it include ADG’s estimated undiscounted future energy production revenue, which exceeds $50 million, stretching over the next 15 years. It also does not include any sales of the Company’s TecoFrost product that will be re-launched this year.

Moreover, on March 26, Tecogen announced a sale to an affordable housing senior living facility located in New Jersey involving four 200 ton STx Tecochill systems and one Tecopower 75 kW cogeneration unit. The equipment is expected to be installed and commissioned in time for the 2019 cooling season. In other words, backlog has substantially increased once again by this sale, and that revenue can be expected to be earned in the second quarter before the hot summer months begin.

Conclusion

The fourth quarter report and presentation was a mixed bag for Tecogen, although most of the “bad” is backwards looking with the “good” expected to come. While revenue and EBITDA declined, it is obvious that Tecogen is laying the groundwork for an excellent 2019 due to record contracts and tremendous increase to backlog along with an increase to gross margins in Q4.

Any increase to operating expenses should be more controlled as the costs associated with the American DG Energy acquisition have already occurred.

With greater stress on power grids as the urban landscape in New York and across North America gets denser, demand for Tecogen’s clean energy solutions will remain robust.

The chiller segment has strong current and future growth potential driven by the indoor agricultural market as cannabis gains national acceptance. The market appears to agree with our assessment of the quarterly result and conference call as the stock price remains strong at around $4.00, just the under 52-week high.

As the stock price remains fairly steady, existing shareholders can view the fourth quarter financial statements as one step closer to Tecogen achieving its goal of consistently profitable revenue growth. This makes it a prime candidate for a major run towards our target price on positive news or demonstrated profitability. We believe that this is possible in 2019 as sales backlog transforms into more record revenue numbers and profitability on subsequent quarterly results. Smallcaps Recommendation: BUY.

| Smallcaps.us Advice: Buy | Price Target: $9.41 | Latest Company Report (pdf) |

| For important disclosures, please read our disclaimer. | ||