Renforth Resources Presents Attractive New Mineral Resource Estimate for Parbec Property

With a portfolio of five exploration projects clustered along the Cadillac Break in Quebec and Ontario, Renforth Resources Inc. (CA:RFR – $0.04 & US:RFHRF – $0.03 & GER:9RR – €0.02) has maintained a steady pace of activity. Most of the news of late has been focused on the exciting New Alger project. However it is the Parbec property that established Renforth as a serious exploration story in Quebec. Originally acquired through an acquisition deal with Globex Mining, Parbec is the most advanced of Renforth’s holdings and appears to be emerging as a development candidate.

This week Renforth reported a compliant Mineral Resource Estimate for Parbec. A great deal of information was summarized within this concise document, as exploration data from work programs extending back to 2007 was considered in the analysis. This included results from previous operators of the property. The last 4 years of work at Parbec was completed by Renforth with a total of 37 drill holes, each of which encountered gold. The defined gold zone has been confirmed by drilling to a depth of 738m and extends along a confirmed strike length of roughly 1,800m through the property. The system remains open for expansion as further exploration continues.

Of course the highlight numbers of a resource report are the estimated gold ounces for the deposit. A total of 104,500 ounces of gold was estimated in the Indicated category, within 1,822,000 tonnes of mineralization that averaged 1.78 g/t gold. Another 177,300 ounces of gold was classified as Inferred based on 3,122,000 tonnes bearing an average of 1.77 g/t gold.

Open-Pit Mining Scenario Enhances Potential

As always, the significance of the numbers is a matter of context. An established deposit amounting to more than a quarter million ounces of gold certainly adds to the value proposition for Renforth shareholders. Located within one of the most productive mining regions in Canada and proximal to the largest gold mine in Quebec, makes Parbec even more attractive.

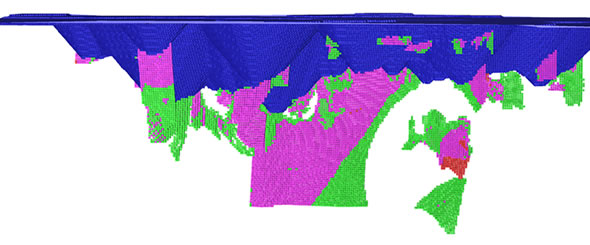

The majority of the resource outlined so far at Parbec are situated near surface. This opens the potential for an open-pit mining scenario. Renforth has considered this option and outlined a pit constrained resource amounting to 100,300 ounces of gold Indicated plus 101,400 ounces Inferred. The pit shell envisioned under this scenario extends 1,300m along strike and only includes resources down to 225m depth.

Blue shows the pit outline, while the other colors show the mineralization outside the pit.

The intrinsic value of a gold deposit is a function of many considerations that impact on the likelihood for a successful mine development. Open-pit mining enables much lower cost operations than a comparable underground mine. Typical open pit mines in operation today are profitable with average gold values of less than a gram per tonne. For comparison, the currently published reserves for the enormous Canadian Malartic mine average 1.11 g/t of gold. Renforth has already surpassed this grade at Parbec with the potential for further gains ahead.

Additional Factors Suggest Further Expansion of the Resources Pending

A cutoff grade of 0.32 g/t gold was plugged into this estimate. All gold intervals below this grade were not considered in the report. This is based on a gold price assumption of $1450 per ounce. Considering that the current gold spot price is in the range of $1700 there may be room to move this assumption higher in a future update. This alone would generate a larger total gold resource for the purpose of modeling the deposit.

However, Renforth is also awaiting further assay results for sample material that is undergoing Metallic Screening analysis. The Company has already presented data for the first batch to be tested that outlined much higher gold grades than were originally determined using only the fire assay process.

Again, the deposit remains open for further expansion laterally and to depth. Considering that Renforth achieved successful results in 100% of the drill holes completed so far, the potential for additional gold zones to be presented as work continues is appealing.

Renforth is also reviewing a 3D model of the resource with the objective to outline sections of the deposit that may be optimized with follow-up drill work. Areas outside of the current pit shell have been highlighted for further investigation. Promising gap zones exist where there was not enough data to assign an estimate for gold values. Increasing the drill density may reveal new resources and upgrade certain zones to the higher confidence classification for future updates.

Moving Forward with Confidence

This resource estimate is just a starting point for Parbec. Renforth remains confident that a much more attractive overall deposit is within reach. The assumptions that were chosen to evaluate the data are considered to be very conservative in nature.

The next phases of the work program will be focused towards further optimization of the resource model to capture additional gold zones that may increase the size and grade of the deposit. Renforth is awaiting the data from the Metallic Screen study to provide additional information on which suites of mineralization may yield more attractive coarse gold values. The Company may also opt to resample sections of older drill core (pre 2007) to highlight areas to follow up with additional exploration.

In the context of the current market action, Renforth is well positioned with a very positive outlook for the future. The Company controls 100% ownership of Parbec and has the luxury to advance strategically with no rush to meet earn-in requirements. As the price of gold moves higher the implied value of the deposit and the size of the overall resource will also increase. The resource estimate has provided the base to grow the project in the next phase of work.

Conclusion

The presentation of a Mineral Resource Estimate is an important milestone for a junior explorer. This report documents the results of many years of exploration work to deliver a reliable estimate of the gold resources using a standardized approach. A framework of value can be established for the property that in turn builds greater shareholder value.

Renforth has advanced Parbec from a promising gold showing to an emerging development candidate with an attractive near surface gold deposit in hand. The proximity to the Canadian Malartic mine, located just 4kms from Parbec, and the similarities of the mineralization of these deposits, will not go unnoticed. This factor alone may contribute towards a speculative premium for Renforth shares as investors ponder the potential for a transaction involving Parbec in the future.

Meanwhile, Renforth remains engaged to continue work programs, aspiring to upgrade the size and average grade of the deposit. Strategic drilling work to expand gold zones may enable subsequent resource updates to include more complete resource data. Laboratory work to confirm higher average gold grades is also in process. These positive factors may build a much larger overall gold resource.

Combined with the aggressive pace of work and promising results being reported at the nearby New Alger property, Renforth is moving forward as one of the most active explorers in Canada. The steady advancement of these two high profile projects serves as the catalyst for a higher share value. Combined with the bullish background for the price of gold itself, Renforth shareholders may look ahead with anticipation to higher market premiums for this attractive stock. Smallcaps Recommendation: BUY.

| Smallcaps.us Advice: Buy | Price Target: $0.29 | Latest Company Report (pdf) |

| For important disclosures, please read our disclaimer. | ||