Preferred Dental Technologies is Seeking to Disrupt the Global Dental Implant Industry in 2019

The junior Canadian stock market has historically been known as the place to put mining risk capital and more recently has ridden the marijuana wave. Preferred Dental Technologies Inc. (CA: PDTI – $0.03) appears to be an out-of-place misfit. However, looks can be deceiving…

The Company, made possible through the technology and leadership of CEO Erik Siegmund, has aggressive plans to disrupt a stagnant global dental implant industry. A lack of design vision for decades has led to long term health issues and dissatisfaction with current dental abutments by clients. An ability to bring this industry into the 21st century through patented technology and a robust business model is what makes PDTI a compelling investment for those investors who are looking for public companies that are stepping into the revenue-generating phase of their life cycle.

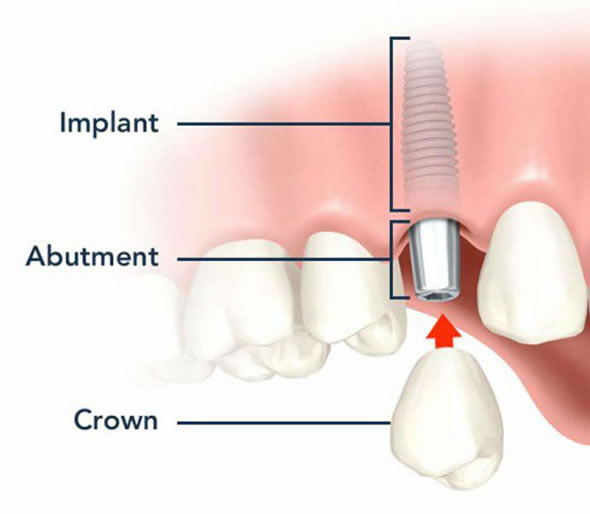

In the past 30 years, there has been virtually no design innovation to the abutment, or connector. Preferred Dental’s Evolutionary Accessory Series (EAS) solves all major problems. The main function of this connector is to provide a stable and strong seat for the crown.

Mr. Siegmund is continuing the legacy and vision left by his father to develop a universal platform for dental abutments which makes easy corrections to misaligned implants and allows for easy care for the rest of the patient’s life. Up until now this idea has remained a dream, but now that product design and contract manufacturing have been secured, Mr. Siegmund believes that PDTI is ready to disrupt by introducing the Company’s Evolutionary Accessory Series (EAS) to the United States, Brazil, the EU and China with sales expected to commence early in 2019.

Conquering the Dental Market Step by Step

PDTI set the foundation in the challenging U.S. market in 2018 through education centers and dental speakers. It has fully trained its sales reps and provided them with sales materials, including a full arch model of the EAS in action for display purposes. PDTI has partnered with a Colorado-based dental technician who can advise the Company on how to approach other dental offices as well as provide peer-to-peer support for those technicians learning about the EAS implant.

Internationally, PDTI has the strong support of a prominent implantologist in Sao Paulo, Brazil, with a full mouth case planned for one of his patients expected to be undertaken in January. The Company has introduced an additional implant platform to its product line known as the external hex which is expected to be particularly useful in Brazil given that over 80% of abutments in the country use this connector type. PDTI has also garnered interest in the EU and China and is looking to partner with dental technicians and/or develop licensing and distribution agreements with reliable third parties.

A Lean Machine

The Company recently hired an internal employee to coordinate sales, but has completely outsourced its manufacturing, fulfillment and shipping and has a fully commission based sales team. This is a smart use of capital. Consequently, with completely outsourced operations and a 40% EBITDA forecast, profitability can be reached relatively quickly and after achieving just a small fraction of the overall dental market. In a recent interview with Smallcaps Investment Research, Mr. Siegmund has stated that PDTI can achieve break even status with just 30 dentists doing only one on four style implant cases a week.

The model is easily scalable which means margins should improve with time when the Company orders larger volume of units from the contract manufacturer. With a proven and profitable business model, Preferred Dental would be able to fund further growth and build inventory through debt rather than equity, limiting future dilution to current shareholders.

Conclusion

Preferred Dental has 69 million shares outstanding and 11.5 million warrants exercisable at $0.10 or higher. At $0.02, PDTI has a CAD$1.4 million market cap. That is a shell valuation, where a company has no operating value outside of the value of its public listing and is planning to undergo a reverse takeover by an operating business.

PDTI offers far more than just a stock listing. It has a dedicated CEO with a clear and ambitious business plan to extend its patented products to two of the largest dental markets in the world in the United States and Brazil. And it is planning to do so not several years down the road, but in 2019, where the timeline to revenue can be measured in months or even weeks. Even at $0.10 and assuming full dilution, that could be had for an $8 million market capitalization.

Everyone talks about weed. Many people talk about gold and mining. In the health care industry many people talk about cancer, heart disease, diabetes and more recently addiction and mental health due to the opioid crisis. Few people are talking or thinking about the dental industry. Which is how a little Canadian company has conquered itself a position at the forefront of the dental implant technology, while being overlooked by the investment community. This leaves an opportunity for risk-tolerant investors to invest in Preferred Dental Technologies at dirt cheap prices in hopes of lottery ticket returns. Smallcaps Recommendation: BUY.

| For important disclosures, please read our disclaimer. |