Participation in Blockbuster Transaction Highlights a Busy Month for Globex Mining

Mineral exploration tends towards the risky side of the spectrum with an uncertain outcome even for the best projects. Therefore having more irons in the fire improves the odds to achieve success. Globex Mining Enterprises Inc. (CA: GMX – $0.78 & US: GLBXF – $0.58 & GER: G1MN – €0.52) has been very effective using the project generator strategy. Many high value property transactions have been achieved, several of which are now advancing towards commercial development. However, even by the standards of this successful track record Globex has been exceptionally busy this month.

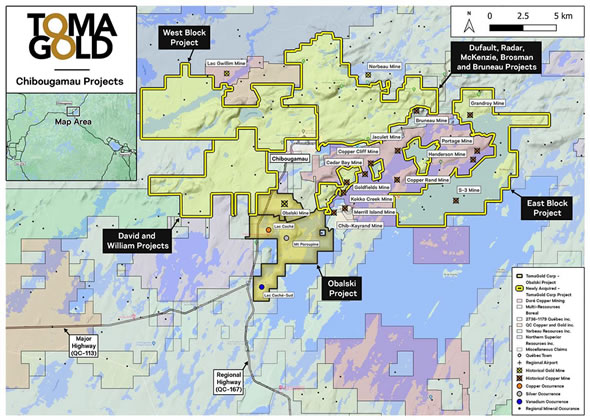

For example, Globex is participating in a multi-phase blockbuster deal with TomaGold Corporation [LOT] for a group of land claims located in the Chibougamau Mining Camp of Quebec. TomaGold’s strategy is to consolidate ownership of a majority of mineral property holdings in this district. The process to assemble hundreds of individual land claims includes individual transactions with Globex, Chibougamau Independent Mines Inc. [CBG] and SOQUEM Inc. This broad-based acquisition strategy will position TomaGold as the dominant player in the Chibougamau Mining Camp, representing the first time in more than 75 years that the majority of land is controlled by one company.

Map of projected acquisitions

Globex Reports New Property Transactions Including Chibougamau Mining Camp Deal

Globex recognized the potential for additional resource discovery within the Chibougamau Mining Camp many years ago. The Company secured ownership of a vast number of individual claims in the area. Much of these holdings were transferred to newly-launched Chibougamau Independent Mines in 2012 when Globex completed a spin out transaction. However Globex relatively recently acquired a group of five claims in the area, assembled to form the Gwillim Lake gold property. This week, Globex announced an option deal enabling TomaGold to acquire 100% ownership of this land package.

Under the terms of this agreement, Globex shall be paid a total of $130,000 in cash, structured over a 5-year term, with $15,000 due and payable on signing. In addition, TomaGold shall issue 625,000 shares to Globex, plus an annual payment of TomaGold shares valued at $25,000 on each anniversary of the agreement for the remaining term. TomaGold has committed to fund exploration expenditures at the Gwillim claims totaling at least $1.5 million during the term of the agreement. Globex shall also retain a 3% GMR for the Gwillim claims. TomaGold will have the option to reduce this royalty to a 2% GMR by issuing payment of $1.5 million in cash to Globex.

Chibougamau Independent Mines Divests Another Property

The most significant portion of the overall strategy in play by TomaGold involves Chibougamau Independent Mines (CIM). An option agreement was reached with CIM to acquire the West Block of claims in the Chibougamau Mining Camp. This consolidated land position amounts to a total of 99 land claims. TomaGold shall issue a total payment of $2,650,000 to CIM structured over a 6-year term, plus a total of 6 million shares of TomaGold within five days of the contract signing. Thereafter, TomaGold shares with a value of $1,350,000 shall be issued to CIM on the anniversary of the option deal for the next five years. CIM and Globex each retain a 2% GMR on the properties involved in this portion of the transaction. TomaGold may repurchase 0.5% of each royalty for a total consideration of $1.5 million split evenly between the two parties.

TomaGold has also issued a Letter of Intent [LOI] for a transaction to purchase the East Block of holdings from CIM. This land package amounts to a total of 127 property claims. TomaGold shall pay a total $200,000 to CIM for the exclusive right to purchase the East Block of claims within a period of 180 days. The purchase price reserved under the LOI is substantial, amounting to a further $11 million in cash payments to CIM over a period of 2 years.

Under the agreements, Globex will now have a 2% Gross Metal Royalty (GMR) on all the claims potentially being purchased under the LOI and option agreements between Tomagold and Chibougamau Independent Mines Ltd. Globex’s 1% Gross Metal Royalty on iron production from the large Mont Sorcier iron/vanadium deposit is not affected by these transactions.

Multiple Other Transactions Reported

Several other transactions of note were also reported by Globex in a recent update. Agnico-Eagle Mines [AEM] has issued a payment of $2 million in cash to Globex in compliance with the terms of its agreement to purchase the Francoeur/Arntfield property. Agnico-Eagle is committed to payments of an additional $6 million to Globex during the next 23 months to complete this purchase arrangement.

Similarly, Burin Gold [BURG] has issued an installment payment to Globex amounting to $100,000 in cash plus one million shares of Burin. This was pursuant to the previously announced option deal vending the Dalhousie Nickel/Copper property to Burin.

Globex also received a payment of $150,000 in cash from Agregat R-N Inc. This payment was negotiated based on net production of aggregates from a quarry operated on a property held by Globex. As the production milestones are achieved, Agregat R-N will continue to issue payments according to the structure of this deal.

Meanwhile, a package of six lithium claims located in Fiedmont Township has been sold to Jourdan Resources Inc [CLM]. Globex received a total of $100,000 in cash plus 2,040,816 shares of Jourdan through this transaction. Globex shall retain a 2% NSR on this property, of which Jourdan may repurchase half for a cash payment of $1 million.

Rounding out the suite of transaction updates, Lincoln Gold Mining [LMG] has filed a LOI to acquire the Bell Mountain Gold property located in Nevada from Eros Resources Corp [ERC]. Lincoln intends to advance the property to a producing gold mine. This is welcome news for Globex as it retains a 3% GMR on this property and as such the commencement of mine production would generate significant royalty income. Globex is currently receiving $20,000 per year in advance royalty payments related to this project.

Cartier Reports Assay Results for Ongoing Exploration

The receipt of cash and share payments related to property transactions is certainly the highlight story of the month. However, ongoing exploration activity underway by partner companies also contributes to Globex’ attractive value proposition. This week, Globex reported successful exploration results achieved at the Nordeau West project by Cartier Resources Inc [ECR]. Nordeau West was acquired from Globex and consolidated by Cartier into the Chimo Gold Mine project. Cartier has been advancing exploration activity at several targets within this large property area.

Exploration drilling focusing on the Nordeau West claims included deeper targets extending below 450 meters. Cartier has now presented assays results from this work that included a section bearing an average of 3.2g/t gold across an interval of 15 meters. An interval spanning 3 meters assayed 6g/t gold. Other notable intervals were also reported, and the program successfully expanded the deposit area by 175m further to depth. Globex retains a 3% GMR on the Nordeau West claims.

Conclusion

Shareholders of Globex have become accustomed to the steady flow of news that is generated with so many active projects in progress. This latest frenzy of transactions and updates amounts to a busier summer, even as most other participants in the sector are relatively quiet during this time frame.

Of particular interest, the issuance of cash payments to Globex is contributing to an even more robustly funded treasury of $25 to $27 million in cash and shares. The Company is bestowed with an endowment of working capital that is the envy of the junior mining sector. Meanwhile, the portfolio of royalty interests continues to grow (90 royalties out of 232 property assets). A number of the current royalties are held for advanced projects approaching commercial mining operations. Thereafter the royalty income from these projects one of which recently entered production (Fayolle Gold Deposit) will continue to build the financial resources for Globex.

It should also be highlighted that some of the highest value property transactions in the junior mining sector during recent years have involved properties that Globex often acquired for minimal costs. This includes the majority of the mining claims featured in the deal with TomaGold. Globex shareholders should draw a measure of confidence that the project generator strategy has been so thoroughly validated by these lucrative transactions.

The Company continues to manage one of the largest suites of property interests in the sector (232 assets) and it continues to add properties by low cost staking. Therefore, the active pace of deal flow can be maintained in the future. The confirmation of successful work for ongoing partnerships and the prospect of additional deals to be completed will contribute to bullish expectations for Globex shareholders. Smallcaps Recommendation: BUY.

| Smallcaps.us Advice: Buy | Price Target: $2.87 | Latest Company Report (pdf) |

| For important disclosures, please read our disclaimer. | ||