High Grade Gold Values Reported at Duquesne West Gold Project – Excellent News for Globex Mining Shareholders

Ownership of exploration properties in highly prospective districts is the foundation to the creation of value in the mining sector. However, the achievement of a discovery is only the beginning of the process for those fortunate enough to do so. Thereafter, the lengthy process to define a deposit and optimize economic variables along the path to mine development can add up to an expensive endeavor. And many projects fade along the way as the economic viability is compromised due to impairments.

With its impressive inventory of mineral property interests, Globex Mining Enterprises Inc. (CA: GMX-TSX – $0.81 & US: OTCQX International-GLBXF – $0.59 & GER: FRA- G1MN – €0.55) is certainly positioned to succeed in the junior mining sector. Given the harsh reality described above, even if the company focused only on the very best projects, it would still amount to a nearly impossible venture for one company to fund and manage multiple exploration efforts independently. The option to proceed as a project generator and secure active partners to participate in the exploration process is a much better solution. Globex has subsequently prospered as dozens of its property interests have been optioned or vended to partners. Several of these projects are now in mine development with the potential to generate significant royalty income to Globex.

This week, Globex highlighted the exploration progress as Emperor Metals Inc [AUOZ- CSE] presented a batch of encouraging gold assay results from ongoing work at the Duquesne West project. Recent updates were also presented by several other companies operating independently to advance projects for which Globex retains royalty leverage.

Promising Gold Values across Significant Drill Core Intervals Reported by Emperor Metals

Emperor Metals committed to ambitious exploration activity as part of the terms to acquire the Duquesne West project. The company reported this week that a total of 8,239m of drilling has been completed in the current phase of work.

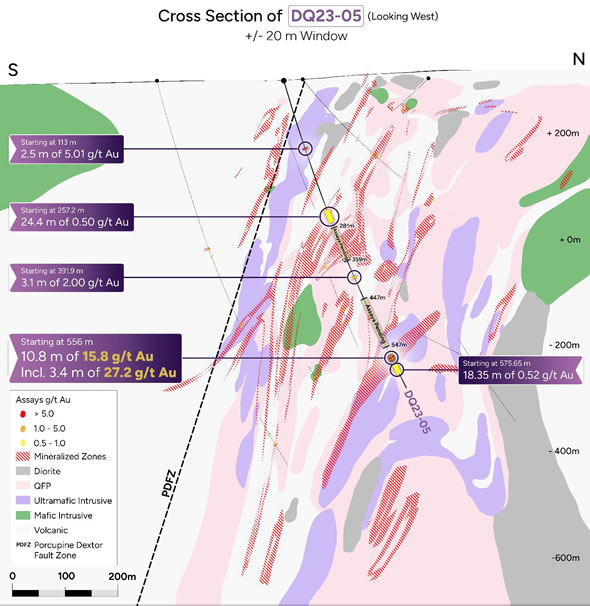

Multiple mineralized intervals were encountered in each of the drill holes, extending to more than 900m in the deepest drilling work so far. The most notable of the gold zones was a section spanning 10.8m with an average of 15.8 g/t gold in DQ23-05. A subinterval within that section was enriched with 27.24 g/t gold over 3.4 meters of core. Emperor believes this drill hole has extended the defined area of the deposit another 100m further to depth.

Cross Section DQ23-05 – It is believed that hole DQ23-05 extends the targeted gold zone an additional +100 metres along plunge.

In drill Hole DQ23-04 a section of 1.2m was mineralized with 19.01 g/t gold. A section spanning 2m was mineralized with 6.14g/t gold in DQ23-03. Many other attractive gold intervals were also achieved including a wider interval of 28.8m bearing 0.33 g/t gold at the deeper extension of DQ23-01.

The ongoing exploration is designed to expand on an established gold resource reported by a previous operator. Compliant resources for the property amounting to more than 727,000 tons with an average grade of 5.42g/t gold are expected to increase significantly as more work is completed.

While higher grade gold values continue to be reported as drilling extends deeper along the system, the objective is also to prove up additional gold zones closer to surface. Emperor has already begun optimizing the pit shells for the potential of lower cost open-pit mining, in addition to the prospect for underground mine development.

Emperor originally acquired this project in October of 2022 through an option deal with Duparquet Assets Ltd. Globex holds 50% ownership of Duparquet and therefore shall receive half of the significant property payments of cash and Emperor shares during the terms of the agreement. In addition, Duparquet retains a 3% Gross Metals Royalty on the project. Emperor may repurchase one third of this royalty at any time for $1 million. Emperor is also required to fund ongoing exploration activity to maintain its option commitment.

Ongoing Activity Achieved by Partner Companies Highlighted in Reported News

Updates have also been issued regarding several other projects of interest to Globex shareholders. Royalty partner Radisson Mining Resources Inc [RDS-TSXV] announced that it has resumed drilling work at the O’Brien Gold project. A program of 10,000m in total drilling will focus on expanding the gold resources of the project. Globex retains a 2% NSR for some of the property area including the key gold resource Trends #3 and #4, targeted in this round of exploration. Globex also retains a 1% NSR for the O’Brien West portion of the property where a gold resource of 293,000 tons with an average grade of 7.59 g/t has been defined.

A potential beneficiary to the Radisson news, Globex also controls 100% ownership of the Central Cadillac – Wood Gold Mines project. This claim group is situated immediately adjacent to the eastern boundary of the O’Brien property claims. Further success achieved by Radisson will therefore enhance the speculative attraction to these adjoining land holdings.

A drilling program at the Lac Escale lithium project in is now underway. Option partner Brunswick Exploration Inc [RRW-TSXV] reported that twelve drill holes have been completed so far for a total of 1000 meters. The lithium mineral spodumene has been identified in pegmatites encountered within intervals ranging up to 52m in width. Assay results are expected before the end of this month. Brunswick will continue drilling as long as weather permits. Further drill programs for winter 2024 are currently being planned. Globex retains a 3% GMR on the property, of which 1% may be repurchased by Brunswick for $1 million.

Meanwhile, Kiboko Gold Inc [KIB-TSXV] announced that it will be completing its maiden resource report for the Harricana Gold project, located 55 kilometres north of Val-d’Or, Quebec. The gold resource estimate may be presented prior to the end of this month and will include the results of recent exploration completed by Kiboko. Globex retains a 2% NSR on the Fontana land claims, covering an area of 85 square kilometers, which were consolidated into the Harricana project.

Conclusion

The strategy to identify and acquire highly prospective property interests is paying off for Globex as transaction partners advance successful exploration activity. Each milestone achieved along the path adds value for retained royalties as the potential that a mine may be developed is further enhanced. Globex has demonstrated success in this process several times in recent years. Recent results continue to build the value proposition for many other properties and royalty interests in the pipeline.

Emperor agreed to a high value option deal for Duquesne West that included aggressive exploration commitments for the next four years. The encouraging results reported so far are validating that transaction. Similar progress independently achieved by Radisson, Brunswick and Kiboko is also moving their respective projects further along the value curve. All of this work is fully funded by partner companies. Globex does not bear any of the financial liability through to mine development, but may anticipate the potential for significant royalty income if the work funded by its partners contributes to the establishment of a producing mine development.

Several wholly owned property assets controlled by Globex are also becoming more attractive as successful activity is reported in close proximity, as is the case with the aforementioned Central Cadillac – Wood Gold Mines project. These projects may eventually become the next high-value transaction targets as the value creation process continues. Smallcaps Recommendation: BUY.

| Smallcaps.us Advice: Buy | Price Target: $2.87 | Latest Company Report (pdf) |

| For important disclosures, please read our disclaimer. | ||