3 Reasons Why We Expect Acme United to Continue to Excel

Since mid August, Acme United’s (ACU – $10.10) stock has risen over 6%. A true achievement amid this market turmoil, thanks to its solid fundamentals, a 3% dividend and strong outlook.

1. Solid Fundamentals

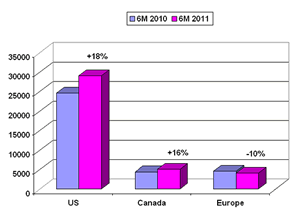

Net sales for Acme United’s second quarter, ended June 30, 2011, were $24.0 million, compared to $20.6 million in the comparable period of 2010, or an increase of 17%. Net income, for the second quarter ended June 30, 2011, was $1,743,000, or $.56 per diluted share compared to $1,567,000 or $.48 per diluted share for the comparable period last year, an increase of 11% in net income and 17% in diluted earnings per share.

In the U.S., net sales rose by 22% in the second quarter compared to the same period in 2010 mainly as a result of strong iPoint Pencil Sharpener sales and Pac-Kit, which contributed about $1.8 million.

In Canada, sales increased by 15% in the second quarter compared with last year, thanks to growth in office products sales, increased distribution channels and a good reception of the AirShoc garden products.

In Europe, sales decreased by about 20% compared with last year, but are expected to pick up strongly in the second half of 2011. In fact, mass market promotional sales, new business in the manicure and office channel along with the deep cost reductions will make Europe profitable during the remainder of 2011.

Acme United’s balance sheet remained relatively stable compared with June 30, 2010. The Company had a current ratio of 3.94, a return on equity of 9.65 and working capital of $39.23 million.

2. Dividend

To show confidence in the business and the market, Acme’s Board of Directors increased the Company’s quarterly dividend with 1 cent to 7 cents per share. At today’s share price, that’s an annual yield of almost 3%, which is substantially higher than the interest rate you earn on a regular savings account or a 10-year bond.

3. Outlook

Our overall guidance for fiscal year 2011 remains at $70 to $75 million in sales and $1.00 to $1.05 earnings per share with potential upward revision in the following report thanks to increased business and possible higher gross margins than first anticipated. Based on our calculations, we reiterate our buy recommendation for Acme United Corp. with a price target of $12.98, which is about 40% above today’s stock price.

| Download your copy of the 11-page Update Report now. |  |

| For important disclosures, please read our disclaimer. |