Renoworks Software Adds Almost $600,000 to Cash Position

Renoworks Software Inc. (CA: RW – $0.60 & US: ROWKF – $0.43), which develops and sells digital visualization software and integration solutions for the remodeling and new home construction industry, received $583,518 from the exercise of warrants this week.

The warrants were issued in connection with the Company’s private placement back in June, 2019 when it raised $750,000 via the issuance of 2,500,000 units at a price of $0.30 per unit.

The additional capital puts Renoworks in the best financial position it has ever been in. Knowing that the Company had about $574,000 in cash at the end of the first quarter of 2021, we estimate that number may now be close to $1.5 million.

The warrant exercise was a big success as 1,458,795 of 1,484,045 outstanding warrants (~98%) participated. As a result, 1,458,795 new common shares were issued, bringing the total number of outstanding shares to 38,423,460.

The proceeds will enable Renoworks to further develop its web-based visualization platform and hire more sales people to accelerating its growth.

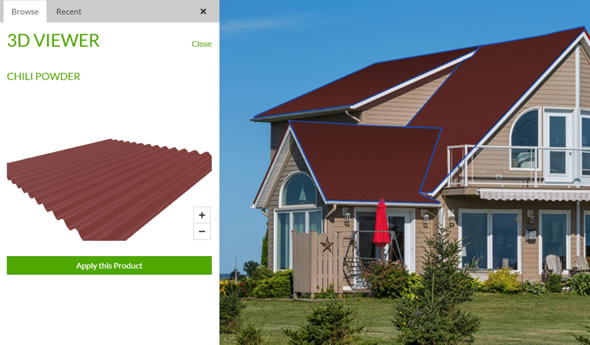

The Company delivers its technology to manufacturers, contractors, builders, and retailers offering solutions to one of the home improvement industry’s greatest challenges: enabling homeowners to review their product selections in a hyper-realistic, virtual environment before committing to purchases and construction.

Acquisition Provides Important Valuation Metric

Other noteworthy news in Renoworks’ sector this week was Builders FirstSource’s [Nasdaq: BLDR] acquisition of WTS Paradigm LLC, a Wisconsin-based software solutions and services provider for the building products industry, for $450 million.

Paradigm specializes in technology, software development and consulting services that help manufacturers, retailers and homebuilders in the building products industry boost sales, reduce costs and become more efficient. As Paradigm was a private company, there wasn’t any financial information available, except that the company was expected to generate approximately $50 million in sales this year.

Dave Flitman, President and CEO of Builders FirstSource commented, “Home construction lags far behind other major industries in the adoption of modern tools that can save time and money, and reduce waste. The acquisition is an important step forward in Builder FirstSource’s strategy to invest in innovative digital solutions that will help our customers build more efficiently.”

Conclusion

Investors who participated in Renoworks’ private placement in 2019 are smiling all the way to the bank. Not only do they have a +60% profit on the shares that they subscribed to, they were also able to exercise their warrants at 40 cents, which is a 20% discount to Renoworks’ current share price.

Also good to see is the extremely high number of investors that converted their warrants. The warrants were obviously in-the-money, but at the same time it also indicates the strong confidence in the Company’s future.

This strong confidence is a direct result of the solid financial results of Renoworks. Both for fiscal year 2020 and the first quarter of 2021, the Company achieved record financials. For the first quarter of 2021, ended March 31, Renoworks reached sales of $1.42 million, versus $1.12 million a year ago, an increase of 27%. At the same time, its net loss decreased from $71 thousand in Q1 2020 to $43 thousand in Q1 2021.

The trend to digitally transform, also includes embracing data analytics. Manufacturers of building products recognize the value that data analytics is bringing to their organizations, such as increased customer revenue, actionable insights and better productivity, enabling them to become more competitive and attuned with customers’ needs.

Home visualizers allow manufacturers, distributers, builders, and retailers to have a tool on their website that increases brand recognition and customer engagement, generates more sales, pushes qualified leads to preferred contractors and provides valuable marketing analytics data on how homeowners interact with their products.

More and more, we see the state of mind of construction industry players changing as they realize the benefit that emerging technology is bringing to their operations. From software solutions that enhance construction design productivity to VR and AR technology, to new homeowner experiences that yield faster remodels and home rehabilitations, the construction industry has never been readier to embrace new innovations.

This is perfectly illustrated by this week’s acquisition of WTS Paradigm for $450 million. Builders FirstSource paid 9 times the 2021 projected sales of Paradigm. What happens if we use this multiple on Renoworks? In 2020, the Company reached total sales of $5.13 million. Increasing that number with 30% gives us estimated sales of $6.67 million for this year. Adding 30% is quite realistic, and maybe even a bit conservative, as Renoworks’ sales increased by 27% in the first quarter of 2021, and traditionally Q1 is the weakest quarter for the Company because of the winter months. Multiplying $6.67 million by nine, we reach a valuation of exactly $60 million. At yesterday’s closing price, Renoworks had a market cap of only $23 million, or a little over one-third of the Paradigm valuation!

All in all, Renoworks presents a combination that is hard to find in the small cap investment space: growing financials, active in a fast growing market, a straightforward business plan that is being executed successfully, and a strong management team. Smallcaps Recommendation: BUY.

| Smallcaps.us Advice: Buy | Price Target: $1.45 | Latest Company Report (pdf) |

| For important disclosures, please read our disclaimer. | ||