Magnitude of Emerging Gold-Copper Discovery at Guayabales Project Warrants Much Higher Value for Collective Mining Ltd.

The reality of mineral exploration is that most grass-roots prospects fail to deliver economic deposits. Even worse, when a discovery is achieved it often becomes less attractive as more exploration is completed. All deposits are finite and it is not unusual that subsequent drilling work does not fulfill initial expectations.

This is not to suggest that speculative investors should avoid junior exploration stories. Exceptional mineral deposits are still being outlined. Larger deposits can sustain a significant mining operation for many years. Successful explorers that are able to present substantial mineral resources tend to become highly valued as acquisition targets for senior mine developers. Close scrutiny is required for successful speculation in the sector but the gains from just one big discovery story can more than offset the losses of a basket of those that fail to measure up.

Collective Mining Ltd. (CA: CNL – $4.08 & US: CNLMF – $2.93) is emerging as an exploration company that has delivered several grass-roots discoveries from two exceptional properties located in Colombia. The objective is to follow in the footsteps of a previous successful exploration story. Investors may recall a significant transaction in 2020 when Zijin Mining Group Ltd. [OTCQX: ZIJMF] acquired Continental Gold to gain control of a multi-million ounce gold mine. Several of the individuals involved in that successful management team went on to found CNL as the next project developer based in Colombia. Their proven leadership and exploration prowess are contributing towards yet another significant discovery play that may evolve into a high-value mine development candidate.

Early Stage Exploration Prospects Secured in Colombia through Option Deals

To establish the foundation for this new exploration venture, CNL acquired the Guayabales and San Antonio projects through option deals. Both expansive property holdings are located within a prolific mining camp of Colombia featuring numerous producing mines. These transactions were partly enabled by the strong contacts in the mining community and positive track record achieved by the management team through their previous success with Continental Gold.

Preliminary exploration commenced almost immediately at each project and shortly thereafter, maiden drilling programs got underway. This work led to significant discoveries of attractive porphyry-style mineralization in 2021-22. While either of these superb exploration prospects could easily represent the flagship project for almost any other junior exploration story on the planet, CNL opted to focus activity at Guayabales.

A general view of the Guayabales Project looking north from the access road to the town of Caramanta on the far ridge

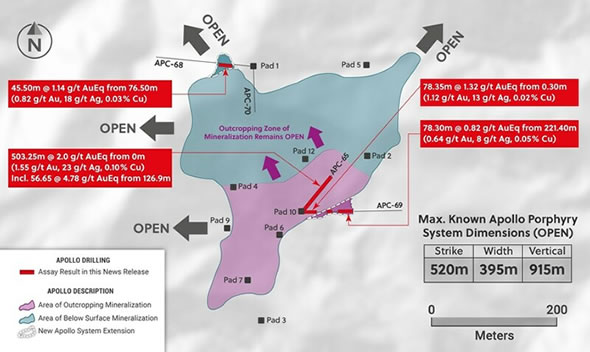

The main Apollo discovery target has evolved into a large deposit. However, porphyry deposits often occur as clusters and several of the other nearby targets have now been tested. Wide intervals of drill core bearing encouraging grades of gold, copper, silver and molybdenum values have been steadily reported.

Creating the Opportunity for Shareholder Value

As mentioned above, most exploration projects become less attractive and less viable for development as more information is learned through exploration. Sadly, it is not unusual in this sector that junior explorers will conduct just enough work to ‘look busy’ and hype up an otherwise ordinary property with very limited upside potential. However, the Apollo deposit is proving to be something special that is increasingly rare in terms of legitimate discovery clout.

Superb results have been presented so far at Apollo. Consider the most recent batch of assay results that were reported in late September. One of the drill holes delivered continuous mineralization starting from surface and extending more than 500 meters down hole, bearing an average grade 2.0 g/t gold equivalent. This excellent drill hole was not an isolated event either. Earlier in the month CNL reported another batch of results that included one drill hole spanning 593.65m with an average grade of 1.69 g/t gold equivalent.

This project does not appear to be running out of steam. Comprehensive exploration is expanding the mineralized footprint of the deposit area in leaps and bounds. Interpretation of geophysical survey data suggests a surface area of more than a square kilometer just for the main Apollo target. The deposit remains open along strike and to depth, where even some of the longest drill core intervals have ended in mineralization.

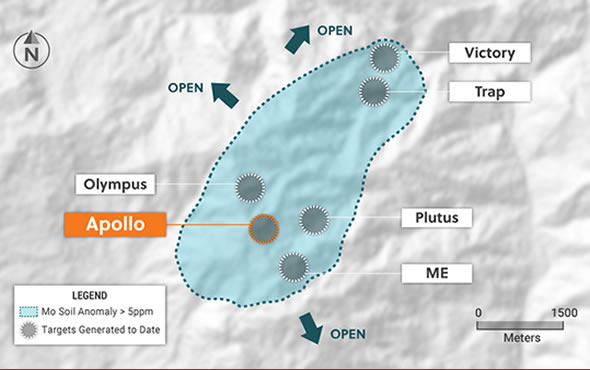

Established geophysical Footprint of Apollo Target and recent expansion from drilling work

Several other distinct targets on this property have also been identified. Five of these nearby targets have been tested and four new discoveries achieved so far. They may also advance to become satellite deposits for a larger mining plan. For example, the Plutus target was discovered just 500 meters from the main Apollo boundary. In July, CNL reported that Plutus has become a significant porphyry prospect in its own right, spanning 1000m along strike by more than 700m in width. Gold values from Plutus have been reported up to 4.9 g/t along with silver up to 100g/t in the early assay results. The overall magnitude of the Guayabales project continues to increase as CNL expands their focus to other portions of this exceptional property.

Plan view of Guayabales target area

The ambitious exploration program has also been scaled higher as the work continues, with a program target for 42,000m of total drilling budgeted for this year. Another drill rig was added to the overall effort this summer, bringing the total to five active drill rigs. To put this in context, a drilling program of 10,000m is still considered to be an enormous challenge in this sector. Most juniors lack the financial resources to pull this off. In contrast, CNL is forging ahead with an exploration strategy that is active and effective, representing a case study for successful resource discovery.

Peer Group Value Comparison

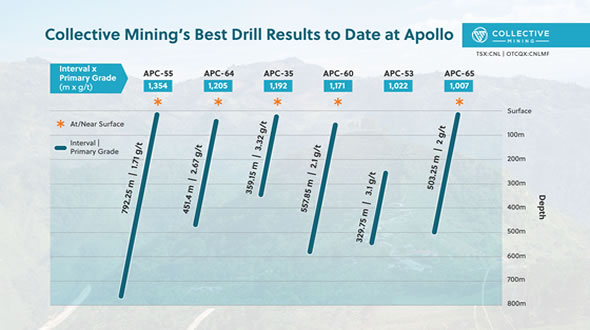

In just two years of drilling so far, numerous wide intervals spanning hundreds of meters, continuously mineralized with attractive grades have been reported by CNL. These are the results that can rapidly build the tonnage and total resource potential for the deposit. Ideally a large deposit will also have enriched metal grade but it is tonnage that enables a large mine to operate for many years to justify the hefty capital investment necessary to develop a project. The overall setting for these emerging deposits will also contribute to shareholder value as they are located at or near-surface and with broad mineralized footprints that would be amenable to lower cost open-pit mining methods.

Chart of most significant drill core intervals from Guayabales

CNL has not presented a NI43-101 compliant resource yet for any of the discovery zones. If the existing deposit areas encountered so far were to pinch out with no further expansion it is still likely that a mine will be established at Apollo with millions of ounces of gold equivalent resources. More likely, a much larger deposit area is awaiting confirmation as the exploration continues. The upside for this story comes down to the potential that a truly world class discovery may be in process. As each round of assay results is presented to expand the overall area of the deposit the projected speculative value usually increases in tandem.

Deposits above five million ounces of gold tend to command premium acquisition valuations. For example, last year Kinross Gold Corporation [NYSE: KGC] acquired Great Bear Resources Ltd. The transaction valued at CDN$1.8 billion secured the Dixie project in Ontario. Of note, only a preliminary resource estimate was calculated for Dixie when the acquisition deal was achieved. Kinross subsequently announced a compliant resource amounting to at least 8.5 million ounces of gold for the deposit.

On the lower end of the scale, GT Gold was acquired by Newmont Corporation [NYSE: NEM] in 2021, in a deal valued just under CDN$400 million. The transaction secured control of the Saddle North deposit in British Columbia, with estimated resources of 1.81 billion pounds of copper and 3.47 million ounces of gold Indicated, plus 2.98 billion pounds of copper and 5.46 million ounces of gold Inferred.

Enterprise values for peer companies have a wider variance and it is difficult to establish apples-to-apples comparisons in this sector. Consider Snowline Gold Corp. [TSXV: SGD], an explorer with a market cap at nearly $700 million advancing several high-magnitude exploration projects in the Yukon. The results achieved by Snowline are very similar to the intervals and grades reported by CNL recently at the Guayabales property. The share price for Snowline surged from just over a buck in July 2022 to a peak of more than $6 per share in August of this year, based primarily on strong exploration results. This is a good indication of how CNL may perform if the impressive reported assay values continue with further work at Guayabales.

Another similar story, I-80 Gold Corp. [TSX: IAU] is advancing development of several large gold deposits in Nevada with combined clout in the millions of ounces of gold resources. The market cap for I-80 is currently in the range of $575 million. Vizla Silver Corp. [TSXV: VZLA] is weighted to silver ounces but presents a substantial resource assembled from multiple wide intervals bearing high-grade mineralization. With roughly 200 million ounces of silver equivalent resources the flagship project carries resource clout equivalent to about 3 million ounces of gold. At the lower end of the resource scale, it still represents a significant mine development prospect with a market cap in the range of $290 million.

CNL currently trades at the bargain end of the peer value range with a market cap below $300 million. Just on the basis of the assay results in hand it is likely that if a compliant resource were to be calculated today the estimated resources for Guayabales would amount to several million ounces of gold. Comprehensive exploration activity continues to reveal new exciting discoveries. The speculative appeal for this company and the longer term upside for resource leverage merits a much higher market cap in line with other peers.

Share Structure

| Issued and Outstanding: | 60,600,000 | |

| Options: | 3,700,000 | |

| Warrants: | 1,800,000 | |

| Fully Diluted: | 66,100,000 | |

| Source: corporate filings. | ||

The warrants outstanding were issued as part of a $10 million bought deal financing completed in October 2022. These warrants have a strike price of $3.25 and expire in April 2024.

Financial Strength Builds a Measure of Added Confidence

As presented in the most recent quarterly financial statement, in June 30, 2023 CNL had amassed more than $24 million in working capital with a clean balance sheet. The likely addition of nearly $6 million in cash expected in the months ahead as the outstanding warrants are converted would ensure CNL remains lavishly funded to carry on aggressive exploration work and maintain all property payment obligations.

CNL is committed to an exploration budget of roughly $1.1 million per month. Even accounting for this extremely aggressive activity, the company is able to continue at this pace for roughly two years before another financing becomes necessary.

Management has indicated that the first compliant resource estimate for Guayabales will be prepared in 2025. This event could become the most important catalyst for shareholder value creation. Widely spaced drilling in the early stages of this discovery may limit most of the deposit to classification under Inferred resources but the prospect of documenting more than 5 million ounces of gold is not out of reach for the first resource estimate.

Discussion of Risk Factors

As a group, the junior explorers are among the most speculative stocks in the mining sector. Mineral exploration is expensive, uncertain, and most explorers rely on equity offerings to fund activity. There is always a chance that the next round of drilling will encounter the limit of a deposit, and at some point that is certain as even the biggest and richest discovery is finite. Meanwhile, operating in a third world country has a risk profile of its own.

Having stated the obvious, the actual risk level for CNL is perhaps less threatening. The most attractive element to this story is that Apollo has already been established as a significant discovery with continuous mineralization extending hundreds of meters to depth. Nearby satellite targets may furnish a huge bonus to the overall resources as work advances.

Colombia is a third-world country that has advanced a long way in this century to building a more stable and prosperous economy. The opportunity to achieve an economic deposit is also enhanced by the expectation for a favorable development cycle in this mining-friendly nation. It has been about a year since the most recent democratic election was completed in Colombia and the current government has issued development permits to all three of the companies that have applied so far to build a mine. It should also be noted that ten operating mines are located in close proximity to Guayabales and the economy of the local district is heavily weighted towards mining activity.

Suffice to state that the opportunity for CNL to deliver a world class development prospect and the subsequent upside in shareholder value creation that would be expected in that outcome more than outweighs a sober risk assessment for this story.

Conclusion

The entire mining sector is mired in a bear market that has compressed market value for all players including those with the most attractive profile. Even the most active explorers, advancing exceptional projects, are often trading for less than half of the 52-week highs established in previous months. Extremes in market sentiment are nothing new to this sector, but the lack of interest in the junior explorers for most of this century has manifest into a drought of new deposits worthy of development into significant mines. This reality equates to an ideal set up for contrarian investors that accumulate value stories when they are out of favor in the market.

CNL is efficiently advancing exploration at Guayabales with the potential to achieve a world class gold-copper-silver resource. Nonetheless, as a relatively new entrant in this sector, the company trades at the lower end of its peer group range. Ongoing exploration success in the field will contribute towards expansion of the deposits at Guayabales and support the market value for this story.

For speculators reviewing this company today, the most important aspect to consider is that based on the results in hand, Guayabales is already among the top exploration opportunities in the sector. The magnitude of discovery continues to grow as the scale of exploration has increased. Strong, proven management is leading the effort, and a lavishly funded treasury enables aggressive work to continue for at least 2 more years.

If CNL can deliver gold equivalent resource leverage growth above the 5 million ounce plateau the value proposition becomes compelling. Fill in the blanks for more aggressive assumptions up to 10 million ounces and beyond, which are not out of range if the exploration underway continues to match current results. The stock could easily double in the months ahead based on positive news flow, and yet it would still remain a bargain among its peers. Smallcaps Recommendation: BUY.