How Acme United Achieved Outstanding Q1 Results Despite COVID-19

Acme United (US: ACU – $21.34), the worldwide supplier of cutting devices, measuring instruments and first-aid products for school, home, office, industrial and hardware use, reported net sales for the quarter ended March 31, 2020 of $35.8 million compared to $31.4 million in the first quarter of 2019, an increase of 14%. The first quarter 2020 revenues included approximately $1.0 million from sales of First Aid Central (FAC) products, which was acquired by Acme in January of this year.

Net income for the first quarter of 2020 was $1,277,000 or $0.36 per diluted share compared to net income of $807,000 or $0.24 per diluted share for the same period of 2019, a very impressive 58% increase in net income and 50% in earnings per share.

Sales of first aid and safety products formed the basis for Acme’s growth. The growth in the first aid and safety area was very strong in the first 2 months of the quarter and then surged with COVID-19 demand. Typically, about half of the Company’s global sales are in the first aid area, but that number was higher in Q1. In part because Acme gained market share with its Smart Compliance industrial first aid product line and patented SafetyHub digital replenishment system. In fact, the Company won new business with the largest home improvement and industrial distributors in the United States.

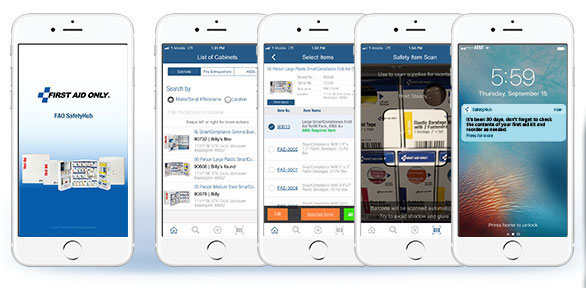

The First Aid Only SmartCompliance requisition app simplifies supply requisitioning and keeps first aid cabinet organized and in compliance.

The Company also noted record demand for its fever-reducing medications, which are sold under the PhysiciansCare brand.

Finally, there was extremely strong demand for masks, gloves, protective equipment and many other items that go into personal protection, spill cleanup, bodily fluid, blood-borne pathogen and first aid kits.

In addition, the Camillus knife business showed strong online sales growth in the first quarter, both in the U.S. and Europe. Especially the sale of machetes peaked.

Acme’s Response to COVID-19

Acme United’s sales teams and offices in the U.S., Hong Kong, Canada, and Germany are working remotely together. The warehouses in Canada and Germany are functioning and the five plants and warehouses in the United States are even running multiple shifts.

Although demand for antiseptic wipes, isolation gowns, masks, and gloves is at record levels worldwide, Acme is able to purchase them thanks to its excellent relationship with Chinese suppliers with whom the Company has worked for many years.

In many cases, Acme purchases these items on the spot market through its Hong Kong office at a cost well above normal, and then adjusts the price accordingly to its customers.

The spot market is a market in which goods are bought and sold for immediate delivery at a price that is good only at a particular moment in time. Delivery usually takes place in the same or next business day.

First Quarter financials and Balance Sheet

| First Quarter Ended March 31 | ||

| Amounts in $000’s | 2020 | 2019 |

| Net Sales | 35,775 | 31,370 |

| Cost of Goods Sold | 22,244 | 19,568 |

| S, G & A Expenses | 11,521 | 10,268 |

| Income From Operations | 2,010 | 1,534 |

| Interest Expense | 322 | 502 |

| Other Income (Expense) | (36) | 11 |

| Pre-Tax Income | 1,652 | 1,035 |

| Income Tax Expense (Benefit) | 375 | 228 |

| Net Income | 1,277 | 807 |

| Shares Outstanding – Diluted | 3,519 | 3,392 |

| Earnings Per Diluted Share | 0.36 | 0.24 |

| Selected income statement data for the quarters ending March 31, 2020 and March 31, 2019. Source: Company Press Release | ||

Gross margin was 37.8% in the first quarter of 2020 versus 37.6% in the comparable period last year.

SG&A expenses for the first quarter of 2020 were $11.5 million or 32% of net sales compared with $10.3 million or 33% of net sales for the same period of 2019. Operating profit in the first quarter of 2020 increased 31% compared to the first quarter of 2019.

Interest expense declined $187,000 in the first quarter due to a lower interest rate as well as lower bank debt. Acme is currently borrowing at 2% interest, while it was 4% last year.

| First Quarter Ended March 31 | ||||

| Amounts in $000’s | 2020 | 2019 | ||

| Cash and Cash Equivalents | 4,272 | 3,798 | ||

| Accounts Receivable | 27,413 | 25,228 | ||

| Inventories | 36,250 | 40,570 | ||

| Total Current Assets | 69,861 | 71,877 | ||

| Property and Equipment | 14,097 | 14,423 | ||

| Total Assets | 108,122 | 110,615 | ||

| | | |||

| Accounts Payable | 5,186 | 5,672 | ||

| Other Current Liabilities | 6,955 | 4,641 | ||

| Total Current Liabilities | 13,411 | 11,343 | ||

| Long Term Debt | 33,853 | 41,340 | ||

| Total Liabilities | 52,297 | 57,747 | ||

| Total Stockholder Equity | 55,825 | 52,868 | ||

| Selected balance sheet data for the periods ended March 31, 2020 and March 31, 2019. Source: Company Press Release | ||||

Acme’s bank debt less cash on March 31, 2020 was $32.9 million compared to $41.2 million on March 31, 2019. This is an impressive result, knowing that during the twelve-month period ended March 31, 2020, the Company paid approximately $2.1 million for the acquisition of the assets of First Aid Central, distributed $1.6 million in dividends on its common stock, repurchased $0.2 million in treasury stock and generated $14.0 million in free cash flow, including a $4.3 million reduction in inventory.

Solid Growth in All Segments

Acme United reports financial information on three separate business segments: the United States (including Asia), Canada and Europe.

Exact revenues per segment for the first quarter of 2020 will be available in the Company’s 10-Q, which will be filed mid-May. However, Acme announced for each segment the percentage by which revenues increased or decreased compared with last year. Based on those numbers, we provide the following estimate.

| First Quarter Ended March 31 | ||||

| Amounts in $000’s | 2020 | 2019 | ||

| U.S. | 30,508 | 27,439 | ||

| Canada | 2,335 | 1,413 | ||

| Europe | 2,932 | 2,518 | ||

| Estimated sales per segment for the quarter ending March 31, 2020 (Source: Smallcaps Investment Research) and actual sales per segment for the quarter ended March 31, 2019 (Source: Company Filing) | ||||

For the first quarter of 2020, net sales in the U.S. segment increased 11% compared to the same period in 2019. The sales growth was attributable to strong sales of first aid and safety products, primarily due to market share gains in the industrial and safety channels, as well as in the home improvement and ecommerce channels. In addition, sales of the Westcott product line declined compared to last year, but this was offset by growth in Camillus knives and DMT sharpening tools.

European net sales for the first quarter of 2020 increased 16% in U.S. dollars and 19% in local currency compared to the first quarter of 2019. This was mainly due to growth in first aid, new customers in the office products channel, growth in the ecommerce channel, and continued growth of DMT sharpening products.

Net sales in Canada for the first quarter of 2020, excluding First Aid Central products, were comparable to the same period last year. However, First Aid Central contributed about US$1 million to the Company’s revenues in the first quarter. FAC, which is based in Laval, Canada, expanded Acme‘s ability to provide safety products which meet Health Canada regulations through the Company’s existing Canadian customer base as well as its large multinational customers.

Conclusion

Acme United finished 2019 with strong results, and its team again delivered in the first quarter of 2020. Demand for the Company’s first aid and safety products remains very strong. However, the global demand for Westcott cutting tools, DMT sharpening products, Cuda fishing tools and Camillus knives may be somewhat softer the following weeks as many stores are still closed. At the same time, Acme’s online business continues to grow, which may help to offset some of the weaker in-store sales. Overall, Acme United is in a strong position to move forward.

Although there is uncertainty due to COVID-19, Acme United’s Chairman and CEO Walter C. Johnsen mentioned during the first quarter conference call that the Company’s U.S. factories are running overtime and that second quarter sales at this point are ahead of this time last year. A very good sign to say the least.

Moreover, Acme has over $16 million additional borrowing capacity on its line of credit, giving it the possibility to take over another company if a qualified opportunity passes by.

Mr. Johnsen concluded, “Acme United had an excellent first quarter. We believe that we are in a strong position to move forward with a solid balance sheet and ample liquidity including $16.1 million in availability at March 31, 2020 under our $50 million line of credit with HSBC Bank, N.A.”

“Nevertheless, we recognize that, like many other businesses, we may face significant challenges resulting from the COVID-19 pandemic including uncertainties around the duration and magnitude of the COVID-19 outbreak. Accordingly, as a result of these uncertainties, we are not providing financial guidance for 2020 at this time.” Smallcaps Recommendation: BUY.

| Smallcaps.us Advice: Buy | Price Target: $59.86 | Latest Company Report (pdf) |

| For important disclosures, please read our disclaimer. | ||