High Value Option Deal for Magusi Mine Project Announced by Globex Mining

A robust bull market for mineral resources underway throughout the year has contributed to a surge of exploration activity within the Province of Quebec. This is very good news for Globex Mining Enterprises Inc. (CA: GMX – $1.05 & US: GLBXF – $0.80 & GER: G1MN – €0.76), a Quebec-based project generator using its home field advantage to secure high quality property interests at low prices. Currently holding more than 200 mining properties and royalties, Globex has been effective to subsequently sell or option these assets at much higher valuations. As a result, a series of successful transactions for Quebec projects this year has generated impressive gains for the Company.

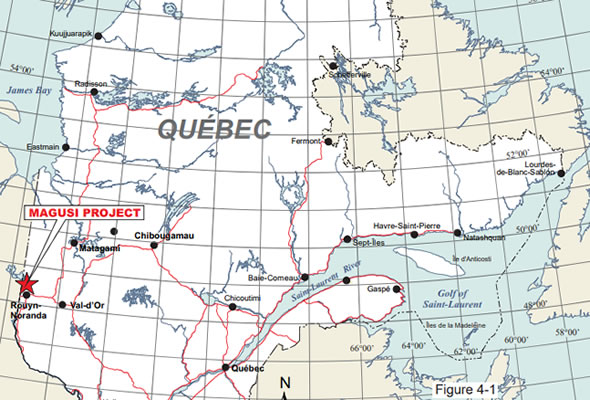

This week, Globex reported yet another high value deal involving an attractive property holding. The Company optioned the Magusi Mine Project to unlisted Electro Metals and Mining Inc [EMM]. The large area of nearly 14,000 acres straddles the borders of Duparquet, Hebecourt and Montbray Townships in Quebec. The property is highlighted by a formerly producing base metals mine along with supporting infrastructure. This purchase option, securing control of an advanced base metals prospect, establishes Electro as a legitimate exploration story.

Magusi Location map

The transaction has been structured with staged payments in cash and shares over several years. This will enable an appropriate time window for EMM to gain its listing and more efficiently raise funding to manage its obligations. Electro is committed to securing a listing on a North American stock exchange in 2022.

The choice to accept a large portion of the total purchase price with shares of Electro in settlement is also a shrewd strategy for Globex. Globex has established a portfolio of shares of its partner companies, issued during previously completed transactions. The value of this portfolio increases as the properties successfully advance through the work funded by its partners.

Attractive Transaction Terms Build Value Proposition

Under the terms of the agreement, Globex shall be paid a total of $6.4 million in cash during a 48-month period, including $1 million payable in the first year. In addition, Globex shall be issued at least 7 million shares of Electro over the same time frame. The total value of these shares must be at least $4.8 million or a grant of additional shares to realize that value must be issued to Globex. At least 2 million shares are payable to Globex during the first 12 months after signing the deal. Electro also commits to complete at least $12.25 million in exploration expenditures during the term of the agreement, with at least $2 million in work programs funded during the first year.

Moreover, the Company retains a 3% Gross Metals Royalty (GMR) on the project. An advance payment of $100,000 per year will also be payable to Globex each year following the 72-month anniversary of this agreement. This is a somewhat unusual clause within the agreement, but it indicates the commitment by Electro to advance the project rapidly through to mine development. Following the commencement of production at the property, any advance payments received shall be credited against the GMR payable thereafter.

Electro has also agreed to complete a positive Feasibility Study during the four year agreement. This in itself is a major milestone for the development of a resource property. The achievement of significant objectives towards mine development also builds the value proposition for Globex.

Long Term Strategy to Advance Magusi Mine Property Validated by Option Partners

Within the current boundary for the property area, the historic Fabie Bay copper mine was established by Noranda Inc. The mine operated through 1976-77 and subsequently closed due to low copper prices. The potential for additional discovery attracted Globex to acquire the claims. Additional land holdings were consolidated to assemble the Magusi Mine property. Thereafter the Company arranged a transaction to vend the project to First Metals Inc. Underground development advanced at the Fabie Bay mine workings and commercial mining resumed, generating royalty revenue for Globex. However First Metals ran into financial trouble and Globex reacquired the project in 2011.

Magusi aerial image

A transaction with Mag Copper Ltd. was announced immediately after to resume activity. In addition to a cash payment of more than $1 million, Mag agreed to spend upwards of $10.25 million in exploration work to advance the project. Mag was unable to satisfy the full terms of the property transaction and returned 100% ownership of the project to Globex.

In addition to the cash payments received from First Metals and Mag during these agreements, Globex was also a beneficiary of the exploration work funded by its partners. Deposit areas enriched with copper and zinc were outlined. An NI43-101 was presented for the project in 2012 documenting more than 1.3 million tons of resources (Indicated) with an average of 1.99% copper, 4.12% zinc and 1.27 g/t gold along with a significant silver content. A further 355,000 tons was also defined in the Inferred classification.

With the attractive resources in hand, market conditions improved as the spot price for copper is now trending in a much higher range. Globex was therefore able to command a much higher transaction value in the deal with EMM to restore the Magusi Mine project on the path towards development.

Conclusion

The evolution of the Magusi Mine property has been ongoing for decades. Along the way, Globex arranged several transactions, earning the Company cash payments and advancing exploration activity. This agreement with Electro represents the payoff for this successful long term strategy. If Electro delivers on its obligations through the full term of the agreement to earn 100% ownership of the project, it will generate a substantial net payment above $11 million in cash and shares to Globex.

Ambitious exploration commitments will contribute to upgrade the resources of the property. The advancement towards a positive Feasibility Study supports the potential to resume productive mining operations. This in turn builds the prospect for Globex to receive substantial royalty income with its 3% GMR held against the project.

The large position of shares of Electro payable to Globex may also be expected to increase in value as the project advances through to a development decision. This portfolio of share ownership in partner companies, acquired by Globex through numerous successful transactions, has itself created a notable shareholder value proposition.

Globex continues to deliver successful results from its asset base of property and royalty holdings. All of the factors related to this latest deal with Electro Metals and Mining may be considered as a superb windfall for Globex shareholders. The long term strategy for the Magusi Mine property has culminated in this high value surprise ahead of the Holiday Season. If EMM successfully advances the project through to production, the subsequent royalty payments will represent the gift that keeps on giving. Smallcaps Recommendation: BUY.

| Smallcaps.us Advice: Buy | Price Target: $2.87 | Latest Company Report (pdf) |

| For important disclosures, please read our disclaimer. | ||