Additional Costco Orders Boost Moon Cheese Sales

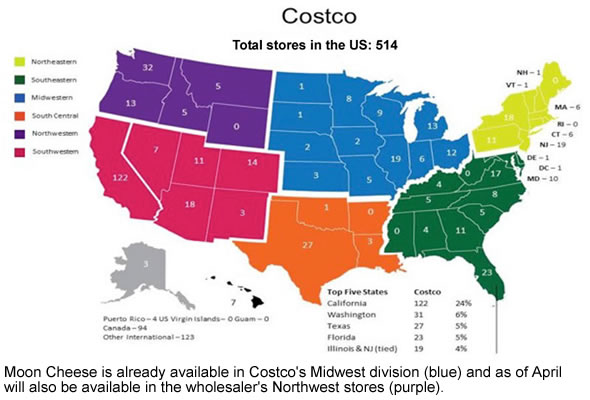

NutraDried which recently became a wholly owned subsidiary of EnWave Corp (TSXV:ENW – $1.23 & OTC:NWVCF – $0.94 & Frankfurt:E4U – €0.74), secured a substantial repeat order for its Moon Cheese snack product from Costco’s Midwest division. Moreover, Costco’s Northwest division placed an initial order a few days ago. We understand that both orders combined are worth close to $1 million.

Late 2017, the all-natural REV dried cheese snack became available in Cheddar and Pepper Jack flavors in approximately 70 stores at Costco’s Midwest division. For the first time, NutraDried offered a “club format” 10 ounce package, which retailed for about $10, while the regular packages are two ounce and sell for $3.99.

The Northwest division counts a little over 50 stores and will only sell the Cheddar flavor Moon Cheese. Also in this case, the club format will be offered. NutraDried is vigorously pursuing additional club format distribution opportunities to build further momentum.

NutraDried also recently added a fifth flavor to its Moon Cheese assortment, Sriracha, where regular Monterey Jack cheese gets flavored with the well-known hot sauce made from a paste of chili peppers. The brand new flavor is already available at Amazon.

The launch of Moon Cheese at Costco continues to remind us of Starbucks. There too, the Moon Cheese snacks immediately were a big hit. Consequently, Starbucks quickly expanded distribution to all of its 7,500 corporate stores in the US. In addition, less than a month later, it also started selling Moon Cheese at its 1,400 corporate stores in Canada.

With Costco’s 741 warehouses globally – 514 in the US and Puerto Rico, 97 in Canada, 37 in Mexico, 28 in the UK, 26 in Japan, 12 in South Korea, and 12 in Taiwan – there’s also tremendous expansion opportunity for Moon Cheese.

EnWave Attending Anuga FoodTec

Next week, EnWave representatives will be attending the Anuga FoodTec show in Cologne, Germany. The global trade fair is one of the most important events of the year for the international food and beverage industry.

The industry presents its innovations and technological visions, from processing, filling and packaging technology to packaging materials, ingredients, food safety and the entire range of innovations from all the areas associated with food production. Another great occasion for EnWave to spread word about its revolutionary REV technology.

Conclusion

NutraDried is clearly building solid momentum. In the first quarter of fiscal 2018, ended December 31, 2017, the subsidiary generated $2.4 million in revenue, compared to $1.32 million in the first quarter of 2017, an increase of $1.08 million, or 81%.

In addition, NutraDried reported net income of $416,000 in the first quarter of 2018, compared to $126,000 in the same period of fiscal 2017, an increase of 230%.

With solid profit margins and additional revenue opportunities, NutraDried is well positioned for exponential growth. The Company is targeting to reach sales of over $10 million in Moon Cheese alone during 2018. In addition, new NutraDried products are scheduled to be launched in the course of the year, and the management has guided that there will be additional key improvements in the corporate structure. Recommendation BUY.

| For important disclosures, please read our disclaimer. | Latest Company Report (pdf) | |

I am here from the beginning of 2015 and with every new contract I hope that enwave will break through. You indicate since the beginning of 2015 that the price target is 3+. What is the deadline for this happening?

How far is the upgrade deal with Bonduelle and what is the status of the renewed interest of Nestle?

Thank you in advance.

WW

Hi William,

Thank you for your comment. It has indeed taken longer than expected for EnWave’s stock price to appreciate to levels that justify the Company’s tremendous progress it has made over the past years.

Being patient is not always easy, especially when you see other stocks doing well that only have a fraction of EnWave’s potential. However, the good thing is that EnWave continues to move forward. As you mentioned, “with every new contract…”, which means that they do sign many new agreements. With each contract, the Company makes progress.

Consequently, we are more convinced than ever that EnWave’s stock will reach $3.5 and much more over time. Personally, I will not sell one share of EnWave that I hold before the stock hits $10.

Hang in there and you’ll be rewarded.

Cheers,

John Peters

I think it’s difficult to conjure up a solid target right now William. Hence the the big air between The Smallcaps $3.49 target vs. Industrial Alliance $1.50 target. We know the the royalty model in the food industry but have no solid number for the cannabis sector. When we have clarity on that end, targets should make more sense. Also as contracts in the cannabis industry roll in perhaps Enwave will also enjoy the built in projected earnings valuations that the cannabis industry has basked in for years.

Just a heads up… here in florida moon cheese was in costco for awhile. and now it’s gone.. sad

Very sad it’s gone. Pls bring it back!!!