Smallcaps.us Initiates Coverage of NSX Silver with Buy Recommendation and $0.83 Target

NSX Silver Inc. (NSY – $0.24) is a Canadian mining and exploration Company focused on advancing its Dios Padre Silver property in east central Sonora State, Mexico, from which 16 million ounces of silver were mined between the early 1700s and 1910.

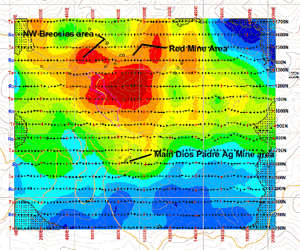

Results from a recently completed geophysics and geochemical program at Dios Padre identified, next to the historically mined Santa Gertrudis open pit, six interesting anomalies. Four anomalies contained high values of copper, gold, silver and arsenic, while one other was a massive lead sulfide zone. The survey also revealed a very large conductive anomaly of 600 metres wide by 800 metres long with a depth of at least 300 metres. NSX commenced a drill program to test these anomalies in March of 2012 from which first results are expected this month.

Based on historic exploration programs, sampling and historic resource estimates, the Company targets to get a resource estimate of at least 60 million ounces of silver at Dios Padre’s primary zone, which can be mined relatively easily, and thus cheaply as an open pit.

NSX Silver has an Enterprise Value per Gold Equivalent Resource of $6.34, while three of its peers trade at a discounted average Enterprise Value per Gold Equivalent Resource of $20.25, or 3.19 times higher than NSX Silver’s. Based on these numbers and the Company’s significant upside potential, we initiate coverage of the Company with a buy recommendation and a price target of $0.83 or 319% higher than today’s 20-day average stock price.

| Download your copy of the initial NSX Silver Company Report. |  |

| Smallcaps.us Advice: Buy | Price Target: $0.83 | Latest Company Report (pdf) |

| For important disclosures, please read our disclaimer. |

Nice report. Based on the Geophysical survey of the large conductive anomaly, what is the most likely composition of the deposit? Copper? Gold / silver? Or does it just imply similar composition to the rest of the property, but in higher concentrations or different geology?

I have always been amazed that First Majestic let this property go, back in 2006, even with a much lower silver price. I think this is what keeps investors a bit wary, until NSY produces its own 43-101 and/or demonstrates high grade drill results.

Thanks TCL.

Well, when I asked Hans van Hoof, NSX Silver’s CEO, during our interview a couple of weeks ago about what the anomaly could be, he only replied that it must be sulphide. That’s all we really know at the moment.

But because they’re currently drilling at Dios Padre, and because the anomaly is one of the main drill targets, I’m sure we’ll find out more pretty soon.

I wanna get this straight – this target is set, assumed on the fact that there is hopefully 60mn oz’s of silver in the ground?

Can someone explain this one to me….what if they prove up 100mn oz’s and that 800x600x300 anomaly is stocked with copper…and gold/silver credits??

Not to mention the smaller anomalies…but this sounds like a double open pit operation to me…