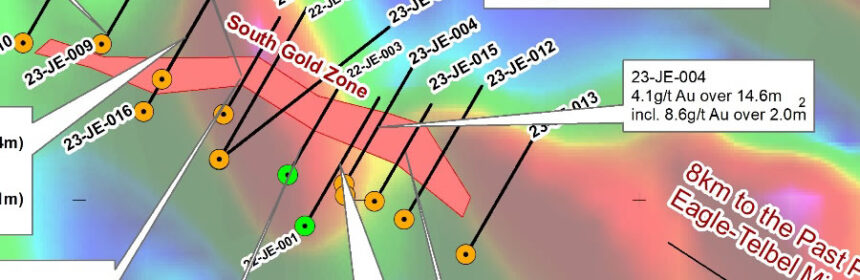

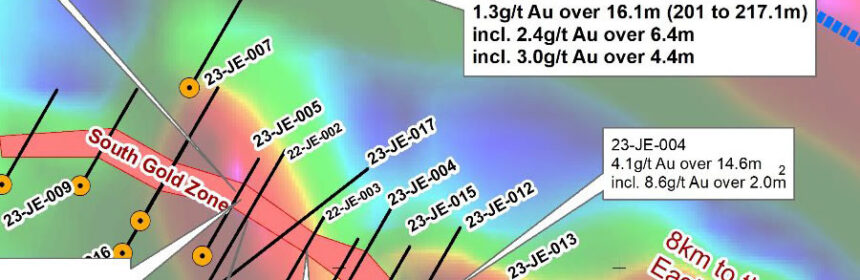

Project Updates From Globex Partners Highlighted by Encouraging Assay Results at Joutel Eagle Property

Another batch of news and updates has been issued that is of interest to shareholders of Globex Mining Enterprises Inc. (CA: GMX – $0.79 & US: GLBXF – $0.60 & GER: G1MN – €0.53). Several option partners are advancing exploration programs and are presenting promising results. Among them, the steady exploration progress achieved by Orford Mining Corporation [ORM] at the […]

Read more