Globex Acquires Kelly Lake Polymetallic Project In Quebec

Globex Mining Enterprises (TSX: GMX – $0.53 & OTCQX: GLBXF – $0.40 & Fra: G1MN – €0.37) is a North America-focused exploration and development project generator. The Company’s business is to acquire mineral properties, and to advance them, either to production or to prepare them for optioning, joint venturing, or outright sale to a third party resource company.

Unlike investments in traditional junior resource companies, where most investors speculate on the outcome of one or two projects, Globex has a much lower downside as it puts its eggs in multiple baskets, allowing them to significantly reduce the inherent risk of the mineral exploration and development business.

Earlier this week, Globex acquired six cells (350 ha) located in Blondeau Township, Quebec, Canada for an undisclosed sum.

The cells cover the Kelly Lake copper (Cu), nickel (Ni), platinum (Pt), palladium (Pd), rhodium (Rh), and cobalt (Co) zone. Work by previous companies and compiled for Loubel Exploration Inc. reports a historical Indicated Mineral Resources of 1,400,000 tonnes grading 0.7% Ni and 0.7% Cu with potential Pt and Pd grades of 0.7 g/t and 0.6 g/t respectively to a depth of 335 metres and open to depth.

Polymetallic Property

It is noteworthy that previous companies that worked on Kelly Lake only focused on the copper and nickel potential. While test data shows that it’s a true polymetallic property with also platinum, palladium, cobalt, rhodium, and even some gold (Au) and silver (Ag). Consequently, much more work is required on the Ag, Au, Co and PGM elements.

The Platinum-Group Metals – abbreviated as PGMs – are six noble, precious metallic elements clustered together in the periodic table. The six metals are ruthenium, rhodium, palladium, osmium, iridium, and platinum. They have similar physical and chemical properties, and tend to occur together in mineral deposits.

Exploration History

In 1968, a composite sample of 4 HQ drill holes weighing 2,800 kg (6,200 lbs) representing 206m (676 feet) of drill core was used for metallurgical testing purposes and assayed 0.77% Ni, 0.63% Cu, 4.10 g/t Ag, 0.10 g/t Au and 0.99 g/t Pt and Pd combined. Metallurgical tests on this composite sample also indicated 0.05% Co and 0.03 g/t rhodium content. Other holes, drilled in 1969, reported up to 4.83 g/t PGMs over 2.25m.

In 2001, Loubel Exploration and Tom Exploration released preliminary results from prospecting work conducted on the Kelly Lake property, where Cu-Ni showings were stripped. Seven BQ drill holes, testing these showings during the first months of 2002, yielded encouraging intersections of 1.80 Ni, 2.87 % Cu, 0.08% Co, 1.12 g/t Pt, 0.67 g/t Pd, 11.0 g/t Ag and 0.38 g/t Au. Results also showed that the thickness of the mineralized zone ranges from 4.5 to 7.5 meters.

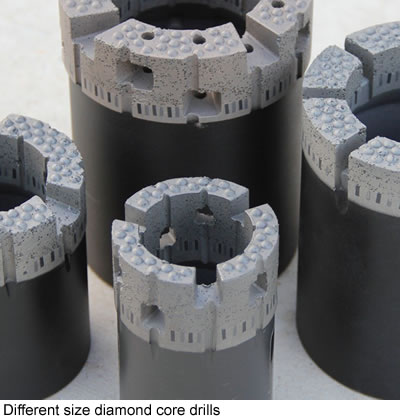

There are five major “wire line” tube sizes typically used (see table below). Larger tubes produce larger diameter rock cores and require more drill power to drive them. The choice of tube size is a trade-off between the rock core diameter desired and the depth that can be drilled with a particular drilling rig motor.

| Size | Outside diameter (mm) | Inside diameter (mm) |

| AQ | 48 | 27 |

| BQ | 60 | 36.5 |

| NQ | 75.7 | 47.6 |

| HQ | 96 | 63.5 |

| PQ | 122.6 | 85 | Standard "Q" wire line bit sizes. Note that 10 mm equals 0.3937 inches |

Work Ahead

Globex has begun acquiring and compiling data from previous work conducted on the property with the intention of initiating an exploration program this summer. Any further work on Kelly Lake will be based on this compilation data. As the snow on the property melts, the initial work will be to take some surface samples to find out how wide-spread the actual mineral resource is.

Conclusion

The positive results obtained by previous owners of Kelly Lake, such as Loubel Exploration and Tom Exploration, confirm the property’s mineral potential. Test data shows that the asset is rich in copper, nickel, platinum, palladium, cobalt, rhodium, and even some gold and silver. Golbex has already started acquiring and compiling data to capitalize on this opportunity.

Work currently underway is focused on delineating extensions to known ore zones, and thus potentially increasing the tonnage of the deposit. In addition, the resource is open to depth. Recommendation BUY.

| Smallcaps.us Advice: Buy | Price Target: $2.87 | Latest Company Report (pdf) |

| For important disclosures, please read our disclaimer. | ||